Ever Wonder Why Halloween Is About Ghosts and Graveyards? 🎃

Happy Halloween! As you know, this season is a time for ghost stories and graveyards, vampires and zombies. But have you ever wondered why so much Halloween imagery, whether silly or serious, is associated with the dead? Why do kids dress up as the supernatural instead of, we don’t know, our favorite fruits and vegetables around harvest season?

Well, Halloween as we know it is really a combination of several, much older traditions. The three foremost, in our opinion, are the Christian season of Allhallowtide, the ancient Celtic festival of Samhain, and the Mexican holiday of Dia de Muertos, or “Day of the Dead.”

All three of which are very much about death — though not necessarily in a scary way!

For all human history, people have been preoccupied with what happens to our loved ones after they die. Are they still around? Will we see them again? And for most of history, people didn’t live very long. War, disease, and famine were constant threats, meaning the idea of death was a constant companion. Much of a person’s life was working just to ensure that their family name would continue after them…so that maybe, somehow, they would be remembered after they were gone.

These questions and concerns helped pave the way for many of the various cultural traditions that would eventually shape Halloween. For example:

Allhallowtide begins on October 31 and lasts through early November. It is a period for remembering those who have died, especially martyrs and saints. During the Middle Ages, children would often go from house to house on the final day of Allhallowtide and beg for money, apples, or sweets called “soul-cakes.” This practice was called “souling”, and involved children chanting “a soul cake, a soul-cake, have mercy on all Christian souls for a soul-cake.”

Samhain takes place on November 1, but celebrations in Ireland, Scotland, and Wales would often start on October 31. According to Irish tradition, Samhain is a time when the boundary between our world and the “otherworld” grow thin — making it possible to communicate with the souls of our ancestors who have departed. Over time, many of the same rituals from Allhallowtide, like costumes, jack o’ lanterns, and souling were also practiced during Samhain. (And some of them probably started with Samhain first before getting adopted by Allhallowtide.)

Finally, Dia de Muertos traditionally begins anywhere from October 31 through November 6. A combination of Allhallowtide and indigenous Mexican customs, the “Day of the Dead” is a celebration of friends and family members who have passed away. It’s a chance to remember them by eating their favorite foods and decorating their graves while swapping stories and funny memories about their lives.

| So How Did Halloween Get “Scary”? In some areas of Medieval Europe, people believed the dead would use Allhallowtide as one last chance to get revenge on those who’d wronged them before moving on to the afterlife. Hollowed out vegetables — early jack o’ lanterns — were used as lanterns to ward off evil spirits, and people would wear masks and costumes so as not to be recognized by angry ghosts. With Samhain, people believed that because the line between worlds were blurred, it was also possible to encounter supernatural spirits and faeries. Many of the same rituals, like costumes, jack o’ lanterns, and souling were also practiced during Samhain. (And some probably started with Samhain before getting adopted by Allhallowtide later.) But at their core, both Allhallowtide and Samhain are more about commemorating the dead than fearing them. |

Three festivals, all around the same time, all when the long day makes way for longer nights, all centered around those who have passed on. Today, of course, the usual Halloween traditions are dressing up in costumes, carving pumpkins, telling ghost stories, and trick-or-treating. Fanciful echoes of past customs and beliefs — and by practicing them, we are, in a way, still paying tribute to our ancestors.

Reading about these origins made us ponder our own family members and ancestors who are no longer with us. Some of them we knew; some we didn’t but have heard about. But many of are just names and dates — assuming we know about them at all. And that got us thinking: Between the scary movies and the endless replaying of “Thriller” on the radio, is there some other activity we can do that’s more in line with the original meaning of Halloween? We think there is!

Genealogy has become an increasingly popular hobby in recent years, from DNA testing to learn where our ancestors came from to scouring digital archives to find out who we are related to. We think that’s because, by gaining a greater understanding of where we come from, we can better understand who we are…and why.

Given that October is also National Family History Month, we think spending time constructing our family trees and learning more about our ancestors, is in perfect keeping with Halloween! By doing this, we are doing what our ancestors used to do: Commemorating and remembering those who came before us so that their memory never fades.

If you are interested in learning more about your ancestors, the National Archives has some tips on how to get started:

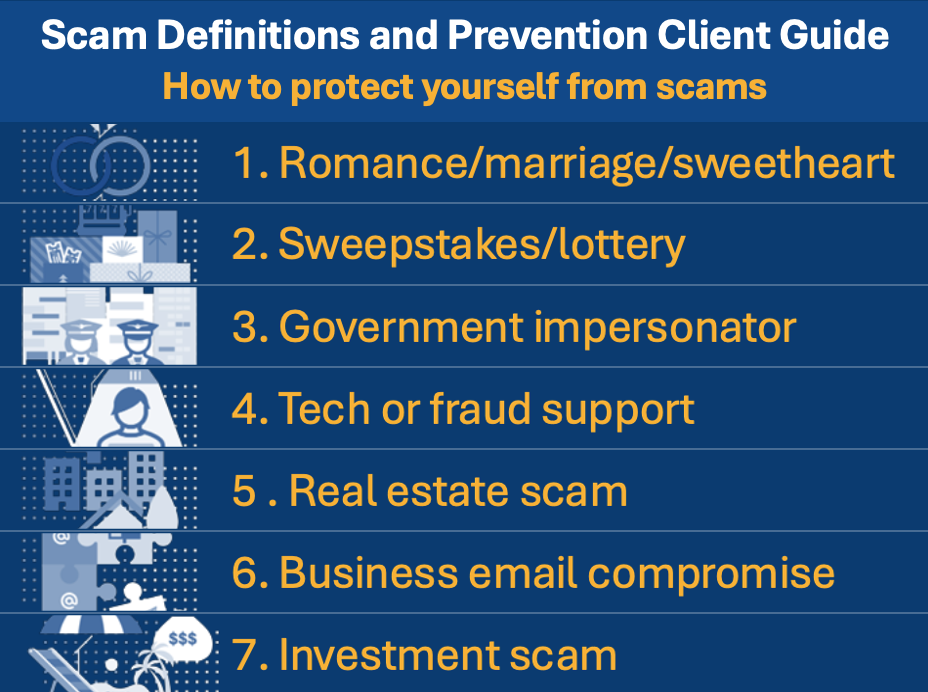

1. Start With Yourself. As they put it, “you are the beginning ‘twig’ on your vast family tree.” Write down all the information you can think about regarding yourself. Then do your parents, working backwards to your grandparents, great-grandparents, and so on. Then, 2. Begin at Home. Look for information about your ancestors in newspaper clippings, birth and death certificates, military service records, diaries, letters, scrapbooks, photo albums, and other documents. Next, 3. Use Relatives as Sources. Visit, call, or write to your older relatives. Ask them what information they have collected, who they know, what they remember. They are the easiest and most vital link to the past. Finally, 4. Comb Federal, State, and County Records. Archives are held at every level containing census data, tax records, marriage certificates, deeds to property and more — all clues to the names and stories of those who gave us our family names.

Halloween is a time for sweets and spooky stories. But at its heart, it’s about something more powerful: Preserving the memory of our ancestors and connecting with the past…so that one day, we will be remembered, too. But however you celebrate the holiday, we wish you a very happy Halloween!