Important Updates for the 2025 Tax Year

Last year, Congress passed the One Big Beautiful Bill Act (OBBB). Among other things, this new law made some important changes to our nation’s tax code. In fact, it’s the most significant tax legislation since the Tax Cuts and Jobs Act of 2017. These two bills are closely related, as the OBBB made many of the TCJA’s provisions — which were originally designed to be temporary — permanent moving forward.

Now that we’re in a new year, many of the provisions of the OBBB have now gone into effect and may apply to your filing for the 2025 tax year. This letter contains some of the most important changes to know about as you prepare to file your 2025 tax return. Our suggestion: Look over the material below and circle anything you have questions about. Then, feel free to share this email with your tax professional! They should be able to answer any questions you have. Of course, our team is also available to help in any way we can.

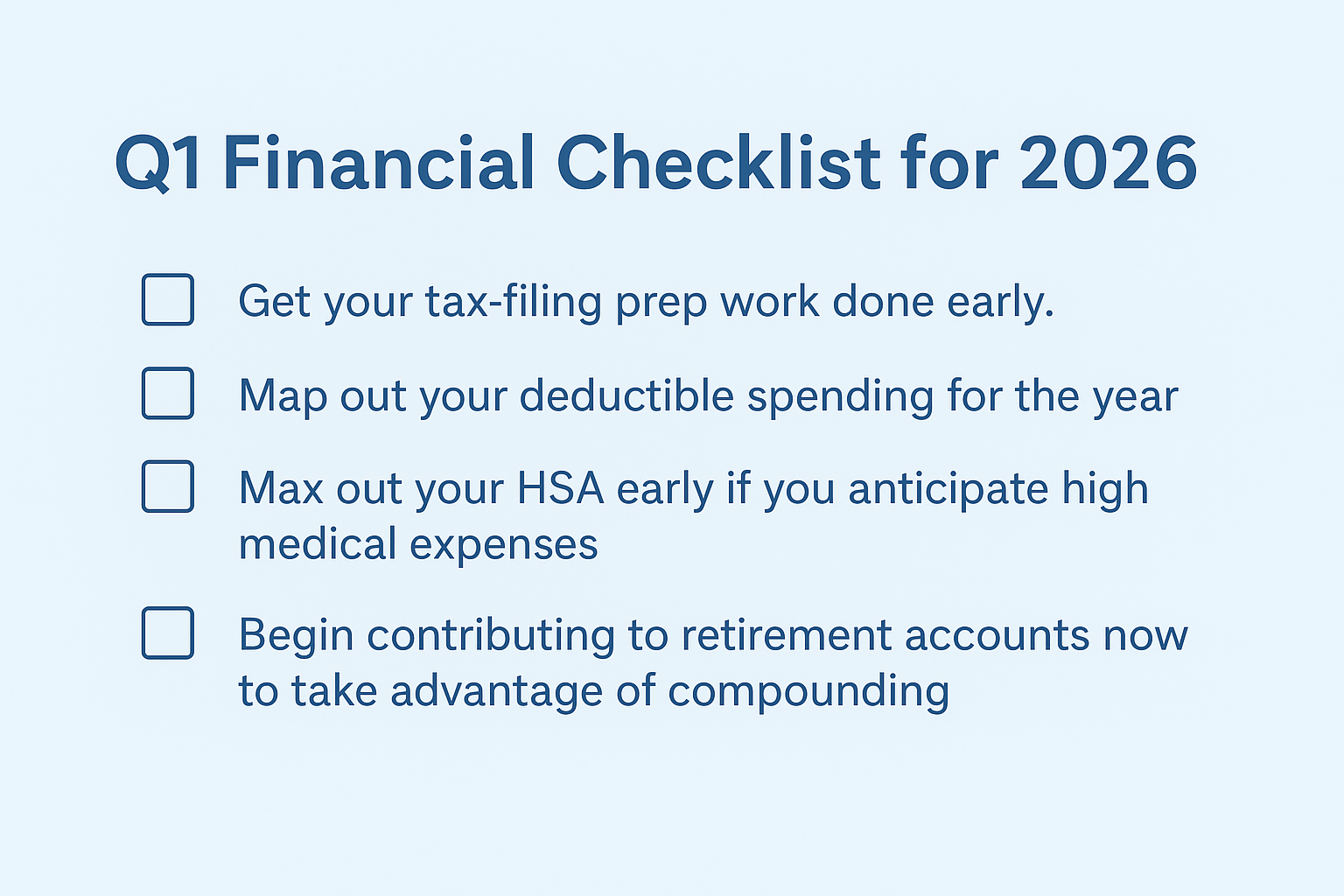

Because of the One Big Beautiful Bill, tax filing may be a little more complicated for some people than it usually is. For this reason, we strongly recommend getting your filing done as soon as you have all your tax documentation, especially if you want to claim any new credits or deductions to either lower your tax bill or receive a higher refund.

Every year, we receive many inquiries asking, “When will I receive my 1099/1099-R?” We understand that tax season can be stressful, so we want to make this process as smooth as possible for you. Schwab issues Form 1099 Composite in three phases, with most forms available in mid to late February. You can access your tax documents as they become available by logging into Schwab Alliance using your User ID and password. If you have not opted for paperless delivery, your tax documents will be mailed to you.

As always, if there’s anything we can do to assist, let us know. Have a great day!

Important Updates for the 2025 Tax Year

Changes to Federal Tax Brackets1

As it often does, the IRS has adjusted the 2025 tax brackets based on inflation. The brackets for the 2025 tax year are as follows:

| Tax Rate | Single | Married, filing jointly | Head of Household |

|---|---|---|---|

| 10% | 0 to $11,925 | 0 to $23,850 | 0 to $17,000 |

| 12% | $11,925 to $48,475 | $23,850 to $96,950 | $17,00 to $64,850 |

| 22% | $48,475 to $103,350 | $96,950 to $206,700 | $64,850 to $103,350 |

| 24% | $103,350 to $197,300 | $206,700 to $394,600 | $103,350 to $197,300 |

| 32% | $197,300 to $250,525 | $394,600 to $501,050 | $197,300 to $250,500 |

| 35% | $250,525 to $626,350 | $501,050 to $751,600 | $250,500 to $626,350 |

| 37% | $626,350 and up | $751,600 and up | $626,350 and up |

Changes to Capital Gains2

The income threshold for the long-term capital gains rate has also increased.

| Tax Rate | Single | Married, filing jointly | Head of Household |

|---|---|---|---|

| 0% | 0 to $48,350 | 0 to $96,700 | 0 to $64,750 |

| 15% | $48,351 to $533,400 | $96,701 to $600,050 | $64,751 to $566,700 |

| 20% | $533,401 and up | $600,051 and up | $566,701 and up |

According to the IRS, there are also a few exceptions where capital gains may be taxed at a higher rate. Those exceptions include selling certain types of small business stock (taxed at a maximum 28% rate), selling collectibles such as coins or art (also taxed at a maximum 28% rate), and selling certain types of depreciable property (taxed at a maximum 25% rate).

Changes to Deductions

Several tax deductions have increased due to the OBBB. For example, the standard deduction has been raised from $15,000 to $15,750 for single individuals, and from $30,000 to $31,500 for married couples filing jointly. For Heads of Household, the standard deduction is now $23,625, up from $22,500.3

For those who choose to itemize their tax deductions, the OBBB also increases the state and local tax (SALT) deduction limit from $10,000 to $40,000. This deduction will increase by 1% each year until 2030, when the cap reverts to $10,000. Note that the SALT deduction begins to phase out for taxpayers earning $500,000 or more in annual income.4

There is also a new temporary personal deduction available specifically to seniors. Anyone born before January 2, 1961, may claim a $6,000 deduction if their annual income is $75,000 or less. (Married couples filing jointly may claim up to $12,000 so long as their combined income is $150,000 or less.) This deduction phases out above these limits, ending at $175,000 for individuals and $250,000 for couples.5 Note that this new deduction isn’t permanent and will expire after 2028.

Finally, the exemption on estate and gift taxes is now $15 million (up from $13.99 million).6

Changes to Tax Credits

The OBBB also enacted some important changes to several types of tax credits — raising one while essentially eliminating others.

First up is the child tax credit, which has now been permanently increased to $2,200, up from $2000 previously. This credit applies to all children who were under 17 by the end of 2025. Note, however, that parents with an annual income of more than $200,000 ($400,000 if married and filing jointly) can only claim a partial credit, not a full one.7

Certain “green” or “clean” tax credits have now expired, however. That includes credits for buying new and used electric vehicles or installing energy-efficient heating and cooling systems, including rooftop solar panels. So, if you bought a new electric vehicle after September, you won’t be able to claim a credit for it. (However, you may be able to claim a credit if you purchased solar panels or a more energy-efficient HVAC system through December of 2025, so it’s still worth looking to see whether this credit applies to you.)

Child Savings Accounts8

The OBBB introduced an interesting provision: A new type of tax-advantaged savings account specifically for children born in 2025 through 2028. So, if you or a loved one welcomed a new baby in 2025, you can file Form 4547 along with your tax return. In response, the government will make a one-time $1,000 deposit into a tax-deferred investment account. Parents and relatives can contribute up to $5,000 a year, and employers can also kick in $2,500. (Note that employer contributions count toward the $5,000 limit.) Any earnings are tax-deferred until the child reaches 18; withdrawals after that point will be taxed as ordinary income.

These accounts can be a handy way for children to save for the future, including higher education. However, there are many rules regarding these accounts, and they may not always be the best option compared to alternatives. For these reasons, let’s chat before you or your family decides to open one!

Taxes on Overtime Pay

Finally, you may have heard that, thanks to the OBBB, there are now no taxes on overtime pay. Unfortunately, this is not quite accurate. Certain workers can claim a deduction on a portion of their overtime pay. The maximum deduction is $12,500 for individuals and $25,000 for joint filers. Note that the full deduction is available only for those with an annual income of $150,000 or less ($300,000 for those filing jointly). The amount phases out above this level and is not available for individuals with an income over $275,000 and couples over $550,000.5

We hope you found this information helpful. Obviously, it’s not a completely exhaustive list of every change for the 2025 tax year, but it is an overview of some of the most important ones. If you have any questions or concerns, please let us know. Our door is always open!

Sources

1 “2025 Tax Brackets,” Tax Foundation, https://taxfoundation.org/data/all/federal/2025-tax-brackets/

2 “Capital gains and losses,” Internal Revenue Service, https://www.irs.gov/taxtopics/tc409

3 “Notable changes under the One, Big, Beautiful Bill,” Internal Revenue Service, https://www.irs.gov/newsroom/irs-releases-tax-inflation-adjustments-for-tax-year-2026-including-amendments-from-the-one-big-beautiful-bill

4 “SALT deduction,” Reuters, https://tax.thomsonreuters.com/en/glossary/salt-deduction

5 “One, Big, Beautiful Bill Act: Tax deductions for working Americans and seniors,” Internal Revenue Service, https://www.irs.gov/newsroom/one-big-beautiful-bill-act-tax-deductions-for-working-americans-and-seniors

6 “One, Big, Beautiful Bill provisions,” Internal Revenue Service, https://www.irs.gov/newsroom/one-big-beautiful-bill-provisions

7 “Child Tax Credit,” Internal Revenue Service, https://www.irs.gov/credits-deductions/individuals/child-tax-credit

8 “How Trump accounts for kids will work,” CBS News, https://www.cbsnews.com/news/trump-accounts-kids-explained/