Words of Wisdom from One of the Greats

On May 12, President Trump announced that tariffs on Chinese goods would be temporarily lowered from 145% to 30%.1 China, meanwhile, agreed to cut duties on American imports from 125% to 10%.1 While this isn’t really a trade deal, in that it doesn’t resolve the many issues and imbalances between the two countries, it does mark a cooling of tensions. That has investors breathing a sigh of relief…because it may mean the worst of this trade war is now behind us. As a result, the markets have largely recovered their losses from earlier in the quarter.

But as nice as it is to see some positive headlines for a change, we actually don’t think it’s the story long-term investors should be thinking about right now.

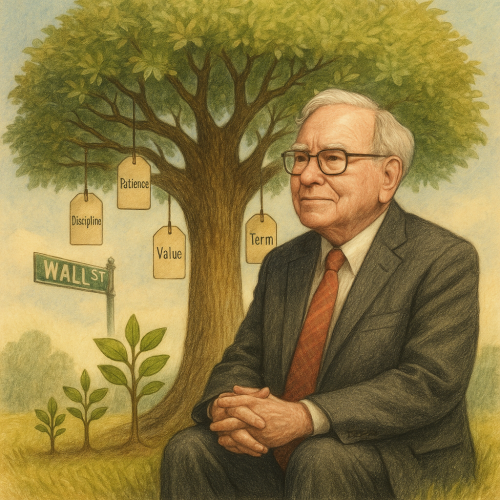

You see, just as there was no reason to panic when the sky was stormy, it’s equally wrong to overreact when the sun is shining. Both are short-term, emotion-driven reactions. Instead, investors should be reflecting on another bit of news that occurred this month: The announcement that Warren Buffett will step down as CEO of Berkshire Hathaway by the end of the year.

“Why does that matter?” you’re probably thinking. Or even, “Who did what now?”

The ninety-four-year-old Buffett is one of the most famous and successful investors in the world. Over the past sixty years, shares in his company, Berkshire Hathaway, have risen 5,502,284%.2 Yes, you read that right, and no, it’s not a typo. That equates to a compounded annual return of 19.9%…nearly double what the S&P 500 has averaged over the same period.2

What’s the secret to his incredible track record? Well, Buffett himself would be the first to tell you that it’s really no secret at all. Furthermore, it’s not due to genius. Or luck. Or having a crystal ball.

It’s discipline.

The discipline to always stick to his investment philosophy regardless of how the markets perform. The discipline to prioritize the long view over the short one. The discipline to leave emotion and ego out of his decision making.

How do we know this? Well, each year, Buffett writes a letter to his shareholders detailing the thoughts behind his decisions. Those letters are available for anyone to read. As a result, investors like us have a huge corpus of wisdom to draw from. So, with Buffett stepping down, and with the markets having been particularly volatile this year, now is a good time for us to ponder the example Buffett set as a patient, diligent, long-term investor. That way, we can better apply those same qualities to ourselves.

With that in mind, here are five lessons to learn from Buffett we can apply whenever markets are volatile.

#1: Leave emotion out of investing. Buffett learned this lesson early on when he first bought stock in a failing textile company called… Berkshire Hathaway. From his research, Buffett discovered that every time the company closed one of their mills, they would use the money to repurchase their own stock. His plan was to buy some of that stock, and when the company sold another mill, sell his shares back for a small profit.

At first, everything went according to plan. After Berkshire closed another plant, Buffett met with the CEO, who offered to buy the stock back at $11.50 per share. Buffett agreed. But a few weeks later, when the actual offer came in the mail, Buffett saw the price was only $11.375 per share. Despite their verbal agreement, the CEO had sneakily decided to pay an eighth less than promised.

It was no big deal in the grand scheme of things, but it made Buffett angry. So, instead of selling, he decided to buy more shares. And more, and more. So many more, in fact, that he soon became the majority owner of Berkshire Hathaway…and was able to fire the CEO who tried to stiff him.

Buffett described it in his 2014 letter as “a monumentally stupid decision.”3 You see, all he had to show for it was a failing company that was now entirely his responsibility. While he eventually turned Berkshire into a corporate powerhouse, the textile business was always a drag on profits. (He finally shut it down twenty years later.) In fact, Buffett estimated that the decision to buy Berkshire, rather than use the money in a wiser and less emotional way, ultimately cost him $200 billion in compounded returns.

The lesson: Never make emotional investment decisions. Instead, always remember that:

#2: “Price is what you pay; value is what you get.” Buffett dropped this line in his 2008 letter to shareholders. Back then, the stock market was in a freefall. Many of the companies that Buffett owned dropped dramatically in price, but as he wrote in his letter, “This does not bother me. Indeed, [I] enjoy such price declines if we have funds available to increase our positions. Long ago, Ben Graham [one of Buffett’s teachers] taught me that ‘Price is what you pay; value is what you get.’ Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.” 4

This describes Buffett’s investment philosophy in a nutshell. Instead of focusing solely on the cost of what he’s buying, he instead focuses on the quality. In 2008, he knew the companies he owned were still strong even if they had gone down in price. So, rather than dump them, he instead focused on buying more of them…while also looking for other strong companies being sold at a discount.

As investors, it’s so easy to get caught up in price. Easy to chase after whatever stock is rising fastest; easy to run away when the markets are in the doldrums. But stock price alone does not tell you how valuable something is — only what people are willing to pay for it in a given moment.

To illustrate what we mean, think about the three most valuable things you own. (Not counting your house.) What would you most want to save if there were a flood or fire? They probably aren’t your most expensive possessions, are they? Before you ever save the big-screen TV or even the car in your garage, you’d probably reach instead for the family photo album. That heirloom your grandmother left you. Or maybe even the $500 guitar you saved up for in high school that’s been with you ever since.

Buffett follows the same principle with business. Instead of concentrating on short-term prices, he focuses on long-term value. The stocks and companies he’ll still want to own in twenty, forty, or even sixty years. That matters, because for Buffett…

#3: “Our favorite holding period is forever.” Buffett said this in his 1988 letter to shareholders.5 We like this quote, because when you think about it, the ideal investment really is something you’d want to hold onto forever, isn’t it? It’s why we pass on our home and our most prized possessions to our children after we’re gone. We want the next generation to derive as much value from them as we did. Here at Minich MacGregor Wealth Management, we try to take a similar approach with your portfolio. While there are, of course, times when we need to sell certain holdings to meet your income needs, our goal is to help you invest for a period far lengthier than the worst bear market or even the longest bull. We invest for your entire lifetime…and maybe even beyond.

#4: Patience always beats prognostication. Investing, when you think about it, is a perpetual struggle between the short-term and the long-term. There are always so many headlines, events, wants, and fears demanding our attention. Because of that, many investors spend an inordinate amount of time trying to figure out “what’s going to happen next.” What direction will the stock market go? How will the economy perform? What will Washington do? As a result, there is an entire industry of forecasters, prognosticators, and fortune-tellers who try to convince investors to make short-term decisions based on short-term predictions.

But nobody can predict the future. We can make educated assumptions, and of course, lucky guesses. When it comes to investing, there’s only one thing we know: That over time, the markets have historically gone up. As a result, patience is often the only requirement. All other ingredients are optional. That’s why, whenever the markets move sharply in one direction or the other, We think it’s handy to remember these classic Buffett gems:

“Our stay-put behavior reflects our view that the stock market serves as a relocation center at which money is moved from the impatient to the patient.” 6 — 1991 letter to shareholders

“Anything can happen anytime in markets. Market forecasters will fill your ear but will never fill your wallet.” 3 — 2014 letter to shareholders

“Investors should remember that excitement and expenses are their enemies. And if they insist on trying to time their participation in equities, they should try to be fearful when others are greedy and greedy when others are fearful.”7 — 2004 letter to shareholders

#5: “Someone is sitting in the shade today because someone planted a tree long ago.”

This, we think, is the greatest lesson of them all.

Can you remember how the markets performed in 1988? 1991? 2014? Probably not — We’d have to look it up ourselves. Similarly, you probably can’t remember what the weather was like in any given month those years, or even what the hit song was.

But you probably can see how far you’ve come since then.

This is the essence of investing. Headlines, whether good or bad, are temporary. Volatility, up or down, is temporary. That is why we always prioritize the permanent over the transient. Why we take the long view over the short one. So, whenever volatility strikes, whenever the headlines get confusing, remember Warren Buffett’s example. Today’s storms are just moisture for tomorrow’s trees — in whose shade we hope to enjoy for generations to come.

1 “US and China agree to roll back tariffs in major trade breakthrough,” CNN, https://www.cnn.com/2025/05/12/business/us-china-trade-deal-announcement-intl-hnk

2 “Warren Buffett’s return tally after 60 years,” CNBC, https://www.cnbc.com/2025/05/05/warren-buffetts-return-tally-after-60-years-5502284percent.html

3 “Berkshire Hathaway 2014 letter,” https://www.berkshirehathaway.com/letters/2014ltr.pdf

4 “Berkshire Hathaway 2008 letter,” https://www.berkshirehathaway.com/letters/2008ltr.pdf

5 “Berkshire Hathaway 1988 letter,” https://www.berkshirehathaway.com/letters/1988.html

6 “Berkshire Hathaway 1991 letter,” https://berkshirehathaway.com/letters/1991.html

7 “Berkshire Hathaway 2004 letter,” https://www.berkshirehathaway.com/letters/2004ltr.pdf