Your Q1 Financial Checklist

Pop quiz: When’s the best time of year to buy Christmas lights?

The answer, as many know, is January — when demand is low and retailers are eager to clear inventory. It’s a simple example, but it reminds us of an important principle: Timing matters, especially when it comes to your finances.

At the start of each year, there are steps you can take that go beyond saving money — they can help you build it. Whether it’s preparing for taxes, organizing savings, or maximizing contributions, the first quarter presents key opportunities to reduce costs, increase returns, and align your financial actions with your goals.

As a financial planning firm, we’ve developed a practical Q1 Financial Checklist for 2026. It includes five actionable strategies you can consider this January—whether you’re managing retirement planning, saving for a major expense, or simply aiming for more clarity and control over your finances.

Of course, not every item may apply to your situation, but if even one of them sparks a conversation or saves you time or money, it’s time well spent.

If you’d like help applying this checklist to your unique goals, we’d be happy to speak with you. There’s no obligation — just an opportunity to plan smarter and start 2026 with clarity. Wishing you a successful start to the year ahead.

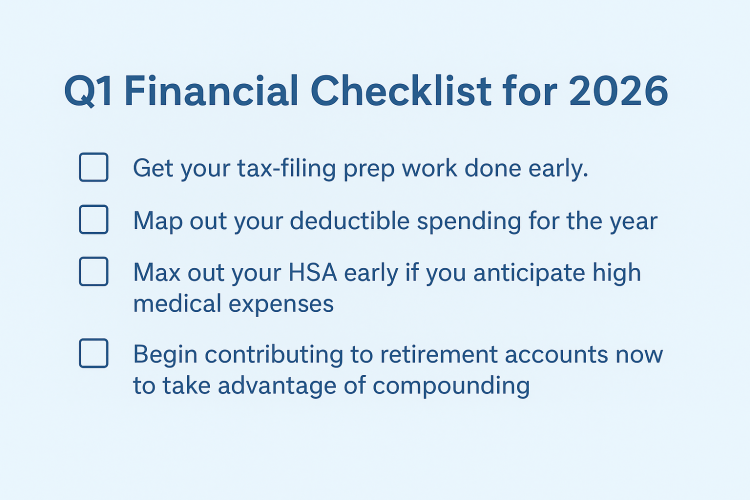

Q1 Financial Checklist for 2026 |

|---|

| Tip: Print this out and stick it on the fridge or somewhere else it will be seen. That way, you can check off the items one by one as you complete them! |

| ▢ Get your tax-filing prep work done early. Let’s get the obvious one out of the way first: Starting sooner on your 2025 tax filing means mistakes become less likely, available deductions or credits are taken advantage of, and headaches are reduced. Start by gathering all necessary tax forms, notices, invoices, insurance statements, and other documents. Keep in mind that many firms cannot send some statements until late March. Then, make sure you have all the necessary Social Security numbers and bank account/routing numbers close at hand. This way, you can spend more time determining which tax credits and deductions you are eligible for and ensure you are reporting all your income. ▢ Map out your deductible spending for the year. We’re looking ahead to 2027 with this one, but hear us out: If you plan to itemize your deductions for the 2026 tax year — as opposed to taking the standard deduction — it’s good to map out those deductible expenses well ahead of time. This includes property transactions, home equity loans, charitable donations, and any anticipated medical expenses. By planning for these now, you can schedule their occurrence for the same tax year — provided it makes sense for your calendar and your budget — which can lead to larger deductions down the road. ▢ Max out your HSA early if you anticipate high medical expenses. Speaking of “anticipated medical expenses,” if you have any elective surgeries, procedures, or expensive tests on the horizon, it may be wise to open a Health Savings Account and then maximize contributions to it as early as possible. Doing this enables the funds inside your HSA to start growing tax-free sooner. Furthermore, if you anticipate hitting your deductible, consider bundling more elective procedures into the same year to maximize how much your HSA can cover. Obviously, any medical decisions you make should be based on your doctor’s opinion, not your financial advisor’s. Still, the point is, be proactive about funding an HSA if you expect major medical expenses this year! ▢ Begin contributing to retirement accounts now to take advantage of compounding. Albert Einstein is famously supposed to have said, “Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.” Whether he actually said this is doubtful, but there’s no doubting the truth of it! If you start maximizing your 401(k) or IRA contributions as early as possible, two things happen. First, you will spread your contributions evenly throughout the year, which is obviously beneficial for your cash flow. Second, you will be giving the money more time to compound in value — and the more you let time work for you, the further your money will go. We don’t need any fancy physics equations to understand that! ▢ Allocate your savings to specific goals. Is 2026 the year you finally remodel the kitchen or put in a new deck? Maybe it’s the year you decide to take your family to the upcoming World Cup — the last time it was held in the United States was 1994, after all. Or maybe you really ant to buy that boat, RV, or motorcycle you’ve had your eye on. Perhaps it’s all the above and more! If so, one of the smartest things you can do in Q1 is think strategically about how you will afford each of these goals. How much will each cost? How much do you already have saved up, and how much do you still need? One smart tip is to open a different savings account for the most important goals. That way, you can see exactly how close you are to each goal. This will help you prioritize which goals you need to allocate more savings to. It will also ensure that the funds for each don’t accidentally get spent on something else. The idea is to be purposeful, organized, and strategic — so that when 2027 rolls around, you can say: “2026 was everything I wanted it to be and more.” |