Q2 Market Recap

One of our favorite metaphors for investing is that it’s like packing a suitcase.

Let’s say you’re preparing for a summer trip to the beach. What would you put in your suitcase? A swimsuit, probably. Sandals. Sunscreen. Plenty of shorts and t-shirts. Sunglasses and a hat. Then, when you take a step back, you realize you still have space for a few more items. What do you choose? More beach gear? Makes sense – after all, it’s the middle of summer, and your destination is famous for being the perfect place to work on a tan.

Or would you pack a pair of pants and a long-sleeve shirt because you guess it might get cold at night? Would you tuck in an umbrella and fold up a poncho…just in case it rains?

In our experience, some investors are like the tourist who packs for one kind of weather and one type of activity. To illustrate what we mean, let’s recap how the markets performed last quarter.

When 2024 began, inflation was near its lowest point in two years. As a result, many investors figured prices would continue to drop, and the Federal Reserve would lower interest rates sooner rather than later. (And possibly even several times throughout the year.) In other words, they “banked” on warm weather and sunny skies, then packed their suitcase accordingly.

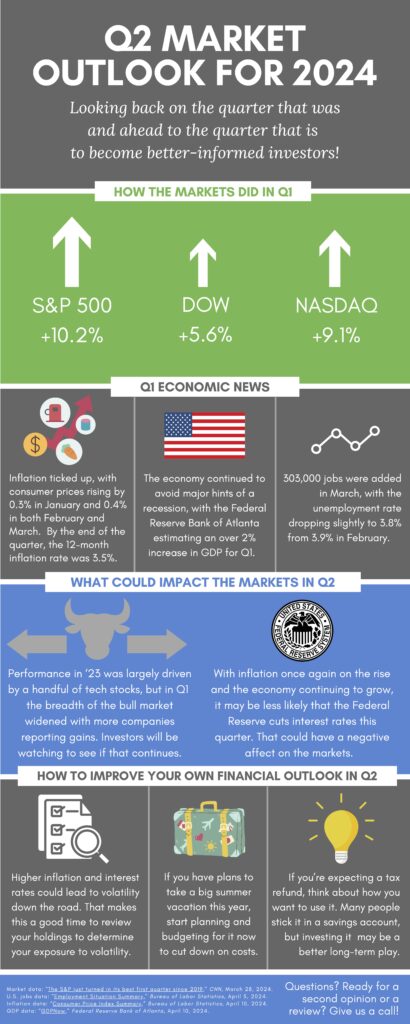

Well, there’s nothing more frustrating than when unexpected rain ruins fun in the sun. Instead of falling, inflation ticked up through Q1, rising from 3.1% in January to 3.5% in March.1

As a result, when the second quarter began, the mood on Wall Street had shifted substantially. Suddenly, there was no more talk of the Fed cutting rates early and often. Instead, investors began to wonder if the Fed would cut rates at all in 2024. Some economists even speculated that the Fed might raise rates again. So, investors re-opened their suitcases. Out went the swimwear; in went the coats and gloves. It’s no surprise, then, that the S&P 500 dropped 4.2% in April.2

What these investors didn’t realize was that the sun was already starting to peek out from behind the clouds.

Fast-forward to the beginning of July. Looking back, we now know that inflation dropped to 3.4% in April, 3.3% in May, and a surprising 3% in June.1

A big reason for this slide is due to gas prices, which fell by 3.6% in May and 3.8% in June.3 (Energy prices in general fell by 2% in both months.3) This helped negate the fact that food and housing prices – two of the most stubborn and volatile drivers of inflation actually went up slightly in June.

As you can imagine, the talk has turned once again…to whether the Fed will cut rates sometime in the summer. This renewed optimism, combined with another factor that we’ll get to, helped lift the markets out of the doldrums. For the quarter, the S&P 500 gained 3.9%, while the Nasdaq rose 8.3%.4

A 3% inflation rate means that consumer prices are up only 3% compared to this same time last year, not that prices have fallen lower. Inflation is the rate at which prices are increasing. A lower inflation rate means that prices are rising more slowly; deflation is when prices actually drop…and it’s usually the sign of an unhealthy economy.

So, what does this mean going forward? Is it time to repack the suitcase?

The answer is no – because we believe we packed it correctly the first time.

Any savvy traveler knows that when you pack a suitcase, you don’t just factor in what you think will happen. You pack for what could happen. If your goal is to hit the beach, you pack a swimsuit…but since you know it could rain, you also pack a poncho. Your plan is to feel sand between your toes, but if the beach is too crowded, you’ll go for a hike instead…which is why you pack shoes as well as sandals.

The way inflation has gone (up and down) and the way the markets have responded (ditto) shows exactly why investing isn’t about predicting what will happen. It’s about planning for what may happen. You pack a suitcase in a way that ensures your vacation will be fun no matter what. We base our investment strategy in a way that helps you keep working toward your goals, regardless of what short-term market conditions are like.

The fact of the matter is we don’t know whether the Fed will lower interest rates in Q3. Of course, it’s certainly possible that they will. Three straight months of declining consumer prices is certainly a good sign. Even better is that the economy has continued to be solid. (GDP grew by 1.4% in Q1.5 As of this writing, many economists are predicting a 2% rise in Q2.6) But it’s also possible that a rate cut is still many months away. Trying to guess what will happen in the short-term – and then making moves that could impact you in the long-term – is bad packing.

Then, too, inflation and interest rate expectations are not the only drivers of the markets. Tech stocks – specifically those companies most involved in the development or utilization of AI – helped the markets regain momentum in Q2. Any investor who decided to sit on the sidelines because of pessimism over inflation would have missed out on the optimism surrounding AI. Sure, it’s always a bummer to go to the beach and find it raining…but there are often plenty of other fun things to do on your vacation even when the sun isn’t out

When you think about it, the markets really are like going on a trip. There will always be reasons for enthusiasm and reasons for caution. Everyone who goes to Disneyland can look forward to amazing rides and horrendous crowds. The view from the Grand Canyon is spectacular; the weather can be abysmally hot. The flowers in England are spectacular; the rain can feel oppressive.

And for every factor that can pull the markets down, there will be factors that could push the markets up. Our job is to help you pack a suitcase – and implement an investment strategy with an eye on the long-term forecast – that keeps you prepared for all of it.

So, as we move further into a new quarter, that is just what our team will continue to do. We’ll be keeping an eye on many things this quarter. Inflation, the breadth of the market, the upcoming election – you get the idea. And whenever we feel there’s something on the horizon that could affect the items in your suitcase, we’ll let you know immediately.

In the meantime, if you ever have any questions or concerns, please let us know. And if you have any upcoming summer travel plans, well…be sure to send us pictures!

Have a great week!

1 “Inflation falls 0.1% in June from prior month,” CNBC, https://www.cnbc.com/2024/07/11/cpi-inflation-report-june-2024.html

2 “S&P 500 falls 4.2% in April,” S&P Global, https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/s-p-500-falls-4-2-in-april-as-market-momentum-loses-steam-81466397

3 “Consumer Price Index Summary, U.S. Bureau of Labor Statistics, https://www.bls.gov/news.release/cpi.nr0.htm

4 “Stops dip as investors digest inflation data,” Reuters, https://www.reuters.com/markets/global-markets-wrapup-1-2024-06-28/

5 “Gross Domestic Product,” U.S. Bureau of Economic Analysis, https://www.bea.gov/data/gdp/gross-domestic-product

6 “GDPNow,” Federal Reserve Bank of Atlanta, accessed July 10, 2024. https://www.atlantafed.org/-/media/documents/cqer/researchcq/gdpnow/RealGDPTrackingSlides.pdf