Pre-Retirement Spring Cleaning Checklist

Spring is in the air, and that means it’s time for spring cleaning. But wait! Before you pick up that dustpan, give a thought to your financial spring cleaning first.

What do finances and spring cleaning have to do with each other? If you’re preparing for retirement, the answer is “A lot!”

These days, the term spring cleaning is often used as a metaphor for getting your affairs in order. As you can imagine, getting your retirement affairs in order is critical if you intend to actually retire when and how you want. There are many things to keep track of, many tasks that need doing, and many decisions to make.

So, how do you begin? Well, when many people do their actual spring cleaning, they make a checklist. What supplies they’ll need, what rooms to organize, what needs to be mopped, vacuumed, dusted…it’s the most efficient way to clean. We suggest doing the same for your finances. So, without further ado, here is a sample Spring Cleaning Checklist to help you better prepare for retirement.

Pre-Retirement Spring Cleaning Checklist

- Contribute the maximum amount to your IRA if you have one. Remember, an IRA is a valuable way to save for retirement in a simple, tax-advantaged way. For 2024, the annual IRA contribution limit is $7,000 up to age 49, and $8,000 for those 50 and older.1

- Review your 401(k) and increase your contributions if necessary. How has your 401(k) been performing? Do you understand how your money is being invested and why? Are you contributing enough to take advantage of any employer matching?

- Start looking at your existing expenses. Which are likely to continue after retirement? What expenses can you remove right now? This is a good way to find extra ways to save for retirement, and it will make your life a lot simpler once retirement comes.

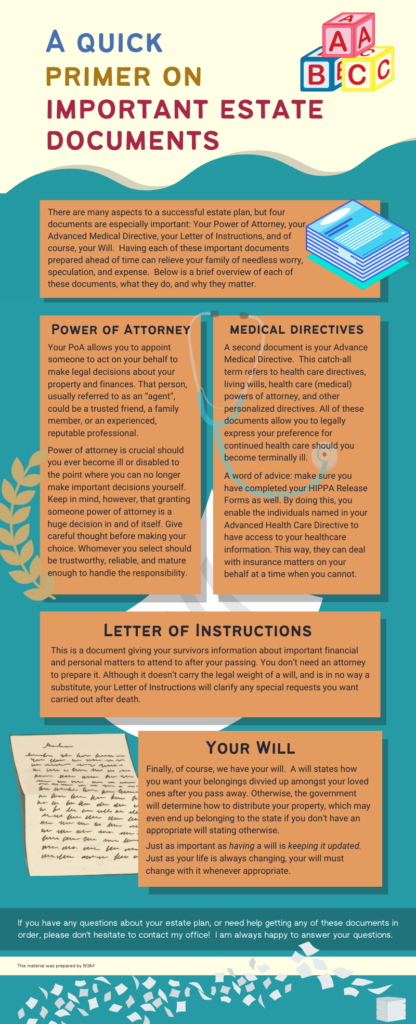

- Make sure you know where all your estate planning documents are. You should have a copy of your will, power of attorney, advance medical directives, letter of instructions, and other documents in a secure but easily accessible place. Make sure your spouse (or other loved ones) knows where these documents are kept.

- Review your current insurance policies. Are there any potential gaps you see? (For example, Critical Illness and Long-Term Care insurance are two types of policies many people don’t have but are often extremely valuable for retirees.)

But most of all …

- Make a list of your top retirement concerns. Is there anything you are confused or nervous about? If so, start getting the answers you need now instead of waiting till you’re already retired. Remember, you want to enjoy your golden years, not stress over them.

- Similarly, make a list of any new goals or dreams you have for retirement. What will it take to achieve or afford them? Are you on track? If you’re not sure, it’s time to start planning.

Spring cleaning is never the most fun thing in the world, but it’s often one of the most beneficial. Just as you probably enjoy living in a clean, organized home, you’ll enjoy the peace of mind that comes with getting your finances in order. Trust us: if there’s one thing we’ve learned in all our years of helping people plan for retirement, it’s that a little organization today can make for a much happier retirement tomorrow.

Of course, if you need help with any of the items on this checklist, please let us know. For example, if you aren’t sure how your 401(k) is doing, we’d be happy to help you analyze it. If there’s a valuable estate planning document you don’t have, we can point you in the right direction. And if you have any questions or concerns about retirement, the chances are good that we have the answers.

In the meantime, we wish you a happy spring—and a happy spring cleaning!

1 “401(k) limit increases to $23,000 for 2024, IRA limit rises to $7,000” Internal Revenue Service, accessed November 9, 2023. https://www.irs.gov/newsroom/401k-limit-increases-to-23000-for-2024-ira-limit-rises-to-7000