A Long Expected Rate Cut

In just about every scary movie, there’s always that one scene near the end where the hero thinks they’ve escaped, or that the monster is dead — only for there to be one more “jump scare” in store.

This is the scenario currently facing the Federal Reserve.

Over the last two years, the Fed has been trying to do the seemingly impossible: Cool down consumer prices without starting a recession. To do that, the Fed turned to the only tool available to them: Interest rate hikes. Rates began gradually rising in early 2022 and had been at about 5.33% since August of last year.1 That was the highest they’d been in 23 years.1

Higher interest rates serve as a kind of flame retardant on the overall economy because they make it more expensive for consumers and businesses to borrow money. This, in turn, reduces how much money people spend. Since a consumer spending is a corporation’s income, lower spending forces companies to lower their prices to attract new business. When this happens across the board, inflation will cool to a more manageable level.

This approach works, but the problem is that it’s applying a blunt instrument to a delicate situation. Since 1955, virtually every period of major rate hikes has led to a downturn.1 If prices cool down too much, too fast, businesses stop hiring. Next, they start laying off workers to make up for the decrease in revenue. The economy contracts, and we have a recession. Some of these recessions were very short, but every downturn is painful in its own way. So, bringing down inflation without bringing down the economy? History suggests it can’t be done.

But the data we’re seeing now suggests that this time, the Fed may have just done it.

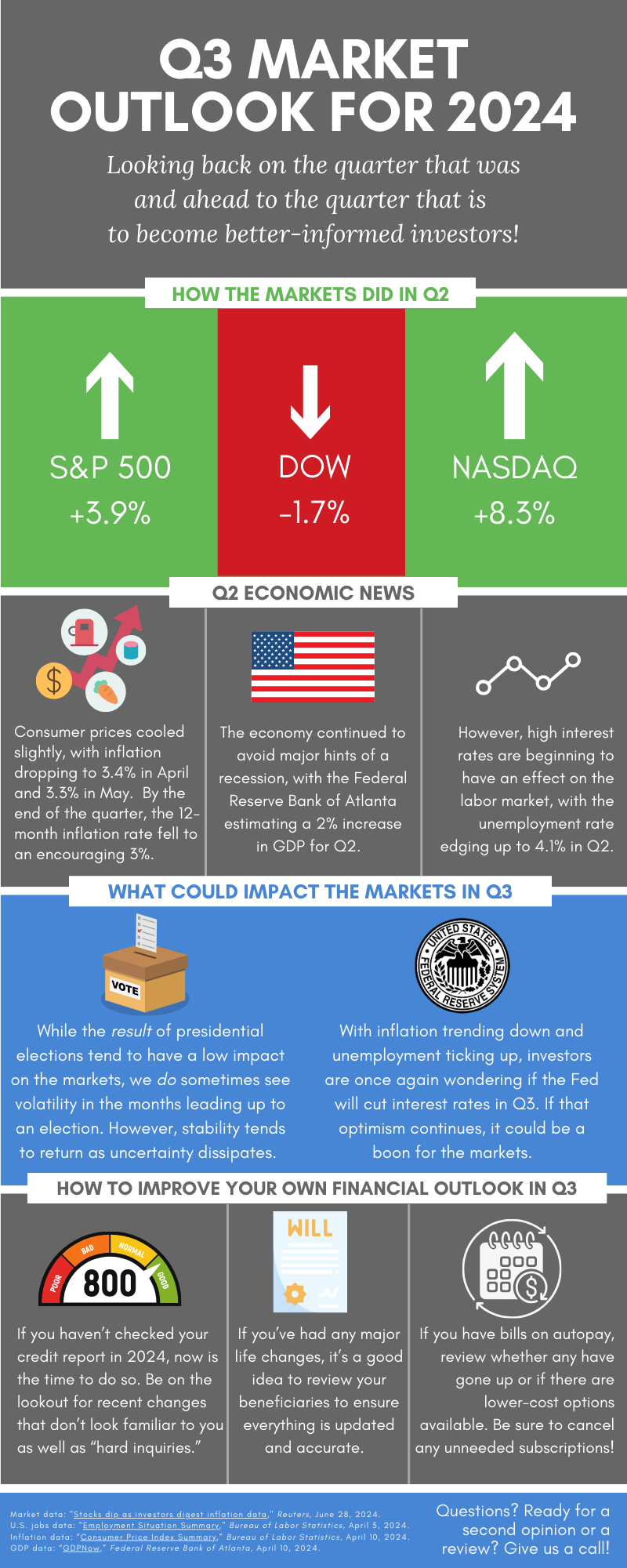

Since the rate hikes began, inflation has fallen from a high of 9.1% in 2022 to 2.5% this past August.2 That’s extremely close to the Fed’s stated goal of a 2% rate of inflation. Meanwhile, the economy has so far avoided a recession. Our nation’s GDP grew by approximately 1.4% in the first quarter of this year, and 3% in the second.3

But in a scary movie, the characters who gloat or celebrate too soon…they never make it out, do they? It’s the ones who keep their heads and don’t get carried away who make it to the credits.

So, the Fed can’t celebrate yet. Just in case the monster isn’t really dead.

You see, while inflation has been going down this year, something else has been going up: Unemployment. After falling to a near-historic low of 3.4% in April 2023, the jobless rate has been slowly but consistently climbing. (The most recent jobs report, in August, showed unemployment was at 4.2%.)4 Now, this isn’t a large number. In historical context, it’s quite low. But what matters is the trend, and the trend has undoubtedly been going up.

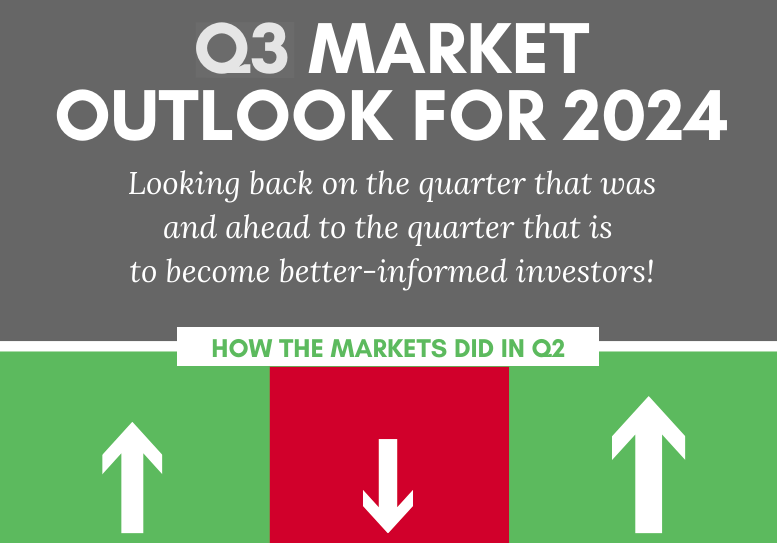

Because of these twin factors – declining inflation, rising unemployment — we’ve known for a while that the Fed must begin cutting interest rates. The question was when, and by how much. Well, now we know the answer: September 18, and 0.50%.5 It’s the first cut in over four years, and it brings rates down to a range of 4.75-5%.

Investors have been waiting expectantly for this for pretty much the entire year. It’s one of the main reasons the S&P 500 has done so well in 2024. So, the move itself wasn’t a surprise. What was a little surprising, though, was that the Fed cut rates by 0.50%. That may not sound impressive, but it’s larger than the 0.25% cut many analysts expected. And it illustrates the new challenge our country faces: How do you cut rates in a way that prevents runaway unemployment without letting inflation climb again?

In other words, how do we ensure the monster’s truly dead? How do we avoid another jump scare?

You see, if the Fed cuts rates by too much, too fast, it could prompt a surge in borrowing and spending. That could overheat the economy and cause prices to spike again, undoing all the progress we’ve made. On the other hand, if the Fed cuts rates by too little, too slowly, it may be too little, too late for the labor market. Unemployment could turn into a runaway train, drawing the economy behind it. The war on inflation would still be won…but at what cost?

As investors, one of the issues we face is that there’s no reliable way to know exactly what will happen. Right now, the economy appears to contain more positive signs than negative, and this new rate cut is a very welcome development. However, it’s worth remembering that rises in unemployment often precede a recession. Furthermore, many past recessions began just after the Fed began cutting rates, not while they were hiking them. When the Fed announced the rate cut on September 18, they also suggested that further, smaller cuts are in store this year. While the markets have embraced the news, and may well continue to rise, we must be mentally prepared for bouts of volatility as investors parse every bit of data for signs of either rebounding inflation or runaway unemployment.

Fortunately, we are set up to respond appropriately to any signs of volatility. Moving forward, as the Fed begins cutting interest rates at last, we’ll continue to analyze how both the overall market – and the various sectors within the market – are trending. As you know, we have put in place a series of rules that determine at what point in a trend we decide to buy, and when we decide to sell. This enables us to switch between offense and defense at any time. If our technical signals indicate it’s time to play offense and seize future opportunities or play defense to protect your gains, we can do so without waiting to see what the overall markets will do.

So, as we move into October, we want you to focus on what really matters. The fall colors. Pumpkin lattes and pumpkin carving. Go watch a real scary movie if that’s your thing.

Are you doing everything you can to help your story contain the words, “Happily ever after”?

Let us help you. For our clients, we monitor the markets, track the data, and adapt as necessary so they need never worry about jump scares.

As always, please let us know if you have any questions or concerns. Have a great week!

SOURCES

1 “Federal Funds Effective Rate,” Federal Reserve Bank of St. Louis, https://fred.stlouisfed.org/series/FEDFUNDS

2 “The Consumer Price Index rose 2.5 percent over the past year,” U.S. Bureau of Labor Statistics, https://www.bls.gov/opub/ted/2024/the-consumer-price-index-rose-2-5-percent-over-the-past-year.htm

3 “Gross Domestic Product (Second Estimate), Second Quarter 2024,” U.S. Bureau of Economic Analysis, https://www.bea.gov/news/2024/gross-domestic-product-second-estimate-corporate-profits-preliminary-estimate-second

4 “The Employment Situation — August 2024,” U.S. Bureau of Labor Statistics, https://www.bls.gov/news.release/pdf/empsit.pdf

5 “Federal Reserve issues FOMC statement,” Federal Reserve Board of Governors, https://www.federalreserve.gov/newsevents/pressreleases/monetary20240918a.htm