2021 Areas of Uncertainty -> Volatility

Everyone knows that April showers bring May flowers. But this year, the saying could be, April tranquility brings May volatility.

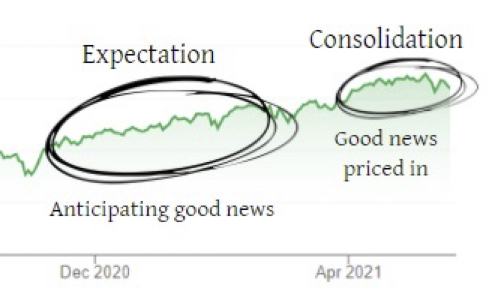

Okay, maybe that saying won’t catch on. But still: Up one day, down the next, flat overall — this has been the state of the markets for the last few weeks. The fancy word for this is consolidation. The markets have been on a tear this past year, and now investors are consolidating their gains, waiting to see what happens next. Think of it as a plane in a holding pattern, circling the runway while it waits for a good time to land.

Why this new volatility in the markets? That’s the question many clients have been asking us. Well, volatility is always a product of uncertainty, and there are several areas of uncertainty that investors are dealing with right now. We’ll address a few…

The first area is inflation.

On Wednesday, May 12, most Americans probably woke up and read the news that Ellen DeGeneres was canceling her show. Or maybe they checked the latest sports scores. We enjoy reading this stuff as much as the next person, but, as financial advisors, our morning was spent reading something else: a news release from the Bureau of Labor Statistics revealing the Consumer Price Index for the month of April.

Here’s how it starts:

“The Consumer Price Index for All Urban Consumers increased 0.8% in April on a seasonally adjusted basis after rising 0.6% in March, the US Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 4.2% for seasonal adjustment. This is the largest 12-month increase…since September 2008.”1

Riveting stuff? Maybe not – but there’s some important information to be found in that paragraph. Here’s what it says in plain English: Inflation is on the rise.

The fact inflation is rising is not a surprise, nor is the reason for it hard to understand. With the worst of the pandemic seemingly behind us, the economy is opening up in a big way. More and more people are going out to eat, visiting theme parks, traveling on airplanes, buying cars, improving their homes, etc. In other words, people are demanding more goods and services.

As we know from the Law of Supply and Demand, when the demand for things outpaces supply, prices go up. With more people are vaccinated, and the CDC recently loosening their mask recommendations, demand has risen sharply over the past few months.

Now, these conditions are all good for economic growth. But for the stock market, there are two issues. The first issue is that this economic growth was largely priced into the markets months ago. Remember, stock market prices reflect what investors anticipate will happen tomorrow more than what’s happening today. Investors expected the economy to grow, so they plowed more money into stocks. Now, the growth is happening, but it’s simply confirmation of what people already expected.

To show you what we mean, here’s a graph of the S&P 500 over the last twelve months.2

So, what’s the next good thing investors can expect? Unknown. That’s the next area of uncertainty. Previously, even when the pandemic was at its worst, investors had a lot to look forward to. A vaccine. Falling case numbers. More government stimulus. But now vaccines are here, case numbers have been falling for months, and there are no more stimulus checks in the offing. It’s like returning from a trip to Disneyland. The kids are exhausted. The parents must return to work. And everyone’s wondering when the next vacation will be.

Until there’s something new to feel excited about, many investors worry there’s a ceiling on how much higher stocks can rise.

Before we go on, let’s return to inflation for a moment. We mentioned there were two issues with economic growth. The second issue is fear. Specifically, fear that the economy will grow too much, too fast.

If the economy grows too quickly, prices will rise across the board and the value of our currency would drop. This, essentially, is inflation: When the general price level rises, a dollar simply pays for less than it used to. That makes it much harder for people to buy the goods and services they need. Or to pay off their debts. It makes it harder for businesses to hire new workers or pay the workers they already have. The upshot? When inflation gets too high, consumer spending plummets, unemployment jumps, and economic booms turn into economic busts.

For investors, the question isn’t about whether inflation will go up. It already is. The question is, will this inflation be temporary, or long-term? The answer will determine how big of a deal it really is.

There’s certainly a good argument that it’s temporary. That’s how the Federal Reserve currently sees it (more on them in just a minute). The thinking is that this inflationary spike is driven by temporary problems related to reopening the economy. As soon as society settles down and regains equilibrium, prices will settle down, too. But we don’t know for sure. It’s not hard to imagine a future where, by the end of the year, the world is still wrestling with the implications of the pandemic. Supply could still be struggling to keep pace with demand. Prices could keep rising. We’re still a long way away from that. But if that is what the future holds, the Federal Reserve would need to do something about it.

And that’s the other area of uncertainty.

You see, the Federal Reserve has what they call a “Dual Mandate”. To put it simply, their mission is to “foster economic conditions that achieve both stable prices [manageable inflation] and maximum sustainable employment.”3

The problem is, it’s not always possible to focus on both goals at once. The Fed must prioritize, and right now, employment is a far higher priority. For the last year, the Fed has helped prop up the economy by buying billions in bonds to keep interest rates low. (Lower interest rates make borrowing less costly, which means businesses and individuals can borrow and spend more, thereby pumping more money into the economy.) But that can’t go on indefinitely. At some point, the Fed must raise rates, especially if inflation keeps rising.

For months, the media has been asking the Fed when they expect to raise rates. For months, the Fed’s answer has been some variation on, “Not until the economy is ready.” Currently, the Fed simply doesn’t see rising inflation as an issue. At least, not compared to the task of getting the economy back to full employment. But for investors who’ve become hooked on the drug of low interest rates, these assurances do little to calm their fears. Why? Well, low interest rates mean that many types of investments, most notably bonds, simply don’t provide the same return on investment as they would in a high-interest rate environment. That drives more and more investors into the stock market to get the returns they need. But what happens when interest rates go up? Consumers and businesses could cut back on spending, which in turn could cause earnings to fall and stock prices to drop.

Rumors persist that the Fed will begin “tapering” their bond-buying sooner rather than later. (This means the Fed will gradually buy less and less in bonds, resulting in a gradual increase in interest rates.) Whenever the headlines even hint at this, the markets tend to spasm. This is the cause behind many of the price swings we’ve seen in recent weeks.

So, that’s the story behind the recent volatility. The question is, what do we do about it?

The first thing we need to do is accept that these areas of uncertainty are likely to persist for some time. In other words, we need to be mentally prepared for a sustained period of consolidation/volatility. If the reverse happens and the markets resume their upward climb? Fantastic! But if not, at least we’ll be prepared.

The second thing to do is remember that we are prepared – for short-term volatility and long-term inflation. If interest rate fears worsen and volatility goes up, we are ready to play defense and move to cash. If there’s a general rise in prices and inflation skyrockets above what the Fed can handle, we don’t have to ride out another market crash like so many investors do. As always, we’ll obey the rules of our strategy and do what the trend dictates. If our technical signals indicate major volatility on the horizon, we’ll act accordingly.

The final thing you can do is let us know if you have any questions or concerns. We’d be happy to speak with you! But in the meantime, keep in mind that while April showers bring May flowers, June sun brings fun! Summer is just around the corner, so go enjoy it. Our team will continue to man the fort around here. If there’s ever any action we need to take, or development you need to know, we will contact you immediately. As always, let us know if there is ever anything we can do for you!

1 “Consumer Price Index – April 2021,” Bureau of Labor Statistics, May 12, 2021. https://www.bls.gov/news.release/pdf/cpi.pdf

2 “S&P 500”, Google.com, accessed May 19, 2021.

3 “The Federal Reserve’s Dual Mandate,” Federal Reserve Bank of Chicago, October 20, 2020. https://www.chicagofed.org/research/dual-mandate/dual-mandate