How to Spot and Avoid Common Scams

Protecting your personal information and assets is more important than ever. Scams are becoming increasingly sophisticated, targeting people through email, phone calls, social media, and even dating apps.

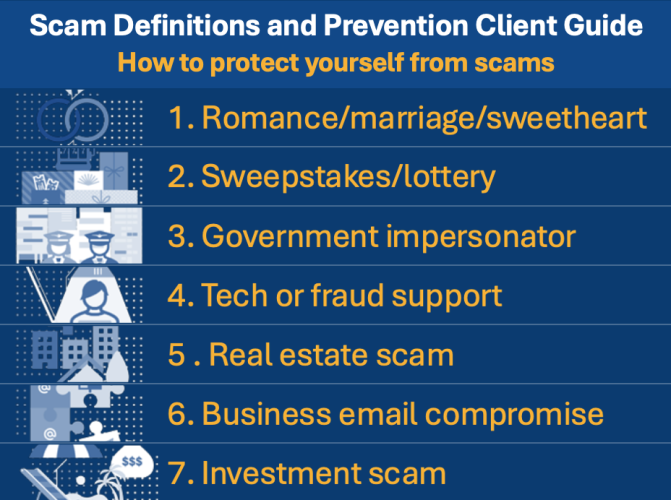

To help you stay safe, we’ve created a Scam Definitions and Prevention Guide. This resource explains common scams and what scammers are doing today:

- Government/authority impersonation: Fake notices or urgent calls claiming to be from the IRS, SSA, or law enforcement.

- Business Email Compromise (BEC): Spoofed or hacked email accounts requesting wire transfers or changes to payment details.

- Tech support scams: Pop-ups or calls insisting your device is infected and urging remote access or payment.

- Romance & “sweetheart” scams: Long-game relationships that pivot to urgent requests for money or crypto.

- Sweepstakes & lottery fraud: “You’ve won!” messages that ask for fees, taxes, or banking info.

- Investment & crypto schemes: “Too good to be true” returns, pressure to act fast, or unregistered platforms.

- Real estate fraud: Fake wiring instructions for down payments or closing funds.

You’ll also find practical tips on recognizing warning signs, preventing fraud, and steps to take if you ever fall victim.

👉 Download the Scam Definitions and Prevention Guide

By staying informed and alert, you can reduce your risk and keep your information and finances secure.

Visit our Cybersecurity page to learn valuable tips on safeguarding yourself and your finances from hackers, scammers, and identity theft.