Forgotten Corners of Financial Plans

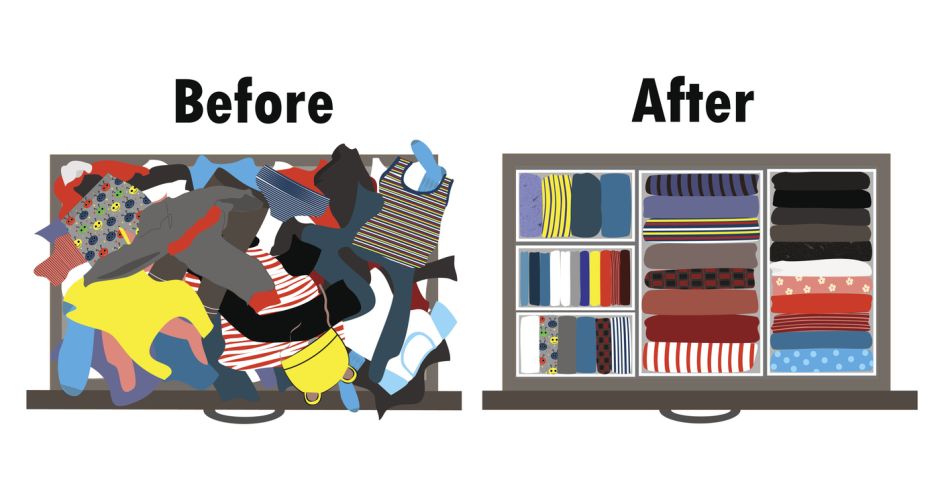

We think everyone has a corner of their house that desperately needs to be cleaned out and organized. Maybe it’s in the garage, with all those miscellaneous cardboard boxes filled with books, baby clothes, and other mementos. Maybe it’s a closet stuffed with coats, random household items, or all those unused rolls of birthday wrapping paper. Or maybe it’s just a random crawlspace that’s hard to access and covered in cobwebs. Either way, when you finally get around to organizing it, one of two things tends to happen:

- You find something you thought was lost or long gone…maybe even something you unnecessarily bought a replacement for!

- You realize you’re hanging on to lots of stuff you don’t really need that’s just taking up space.

Why are we talking about this? Well, as you know, summer is a great time to clean out those forgotten corners of the house. But as advisors, it doesn’t take much for us to take any activity and apply it to finances…which got us thinking about the forgotten corners in people’s financial plans.

And boy are there often a lot of them!

You see, when it comes to financial planning, most people do a good job of focusing on the big stuff — the investments in our portfolio, where our income will come from in retirement, getting our taxes done — just like we’re usually good about keeping the well-trafficked areas of our home neat and tidy. But there are often dusty, neglected corners in our financial lives that we either forget about or ignore. And by doing so, we often pass up opportunities to improve our financial situation — sometimes even leaving money on the table. Or we take longer to reach our financial goals, because there is something taking up space or holding us back.

Here are just a few common forgotten corners of financial plans:

Unproductive funds. Like that jar full of coins and dollar bills that gets shoved to the back of a cupboard, it’s very easy to stick money into a savings account, certificate of deposit, or money market fund and then forget about it. While there’s nothing wrong with using these types of vehicles from time to time, it can also be a very unproductive way to save money, because the cash is just sitting there, uncompounded and often earning very little in interest. At the very least, it’s worth looking to see if there are other, newer options that pay out higher interest rates!

Out-of-date beneficiaries. Many people often opt for a “set it and forget it” mentality when it comes to naming their beneficiaries. But life is always changing and rarely static. That’s why it’s always a good idea to review your beneficiaries every few years in case your family situation or personal wishes have changed.

Mediocre insurance policies. This is a common one. Often, people will buy an insurance policy, such as whole life. Then, never having to use it will let it sit and collect dust. Meanwhile, they will continue to pay premiums on the policy, even if those premiums are overly high and the death benefit is absurdly low.

Unreimbursed HSA receipts. Many people who own Health Savings Accounts often forget to submit their health care expense receipts for reimbursement. Fortunately, there’s no statute of limitations on these expenses, meaning you can submit your receipts for reimbursement even years after the fact!

Your parents’ finances. Those with aging parents know that the day will come when they have to help manage their parents’ financial affairs. Many people try to push off thinking about that day for as long as possible, for a variety of perfectly understandable reasons. Unfortunately, these affairs can become a massive drain on you if left too long.

Your credit score. Some people check their credit score too much; others don’t check it nearly enough. But a good rule of thumb is to check your credit reports at least once per year. After all, these reports aren’t just to help you get loans — they’re a handy early-warning system for fraud and identity theft. That’s why you should always scrutinize them for unexpected changes, hard inquiries from businesses, and other red flags.

Unrealized goals. The most sadly neglected corner of all. Many people have private dreams and ambitions they never express to anyone. Maybe they feel too grandiose. Maybe they seem unrealistic. Maybe they’re just extremely quirky! Either way, a private dream usually stays just that — a dream. But a spoken dream can be planned for, saved for…and ultimately, lived for.

The reason we’re writing all this? Because, as financial advisors, our team makes it our mission to help people — not just with the big stuff in their financial house, but with their “forgotten corners”, too. To that end, if you ever have any forgotten corners that need looking after, please give us a call at 518-499-4565 or shoot us an email at info@mmwealth.com. We would be happy to sit down with you, review your plans, and discuss how to make sure your entire financial house is exactly the way you want it.

Cleaning up the forgotten corners of your home is a great way to free up space, save money, and even gain peace of mind. The same is true with any forgotten corners in your financial life. If you don’t have any, that’s great! But if you do, please think of us. In the meantime, we hope you have a great summer!