Your Q2 Financial Checklist

Did you know that trees have checklists?

Okay, so maybe they’re not written checklists attached to a clipboard, but it’s true all the same. Every year, when winter slowly makes way for spring, there are several criteria that trees must “check off” before they start to bloom.

The first item on their checklist is more sunlight. Trees can detect when spring is near because the days get longer, meaning they receive more sunlight each day. Sunlight, of course, is what trees store and convert into sugars via photosynthesis.

The second is moisture. This isn’t a problem in most parts of the country, where spring rains or melting snow contribute plenty of water. But if the area is going through, say, a massive drought, then trees will often delay blooming.

Finally, trees wait for the temperature to rise. Even if the day is longer, trees know that a sudden blizzard or even overnight frost can wreak damage to any new growth. So, they wait until the average temperature is high enough before dazzling the world with a riot of color.

Why are we telling you all this? As financial advisors, we love checklists, too. After all, if they’re good enough for nature, they’re good enough for us! And with spring – and a new quarter –arriving, it’s time for us to make like a tree and leaf through our own checklist. These are the steps we must take to keep growing closer to our financial goals.

The tasks on this list are all things that should be taken care of in the second quarter. Don’t worry –they’re not difficult! In fact, some may be completed already. But each is important in its own way. If you need help or have questions about any of these, please let us know. In the meantime, we hope you have a great second quarter…and a wonderful spring!

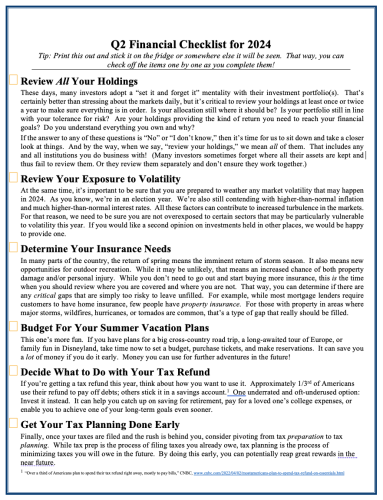

Q2 Financial Checklist for 2024

Tip: Print this out and stick it on the fridge or somewhere else it will be seen. That way, you can check off the items one by one as you complete them!

Review All Your Holdings

These days, many investors adopt a “set it and forget it” mentality with their investment portfolio(s). That’s certainly better than stressing about the markets daily, but it’s critical to review your holdings at least once or twice a year to make sure everything is in order. Is your allocation still where it should be? Is your portfolio still in line with your tolerance for risk? Are your holdings providing the kind of return you need to reach your financial goals? Do you understand everything you own and why?

If the answer to any of these questions is “No” or “I don’t know,” then it’s time for us to sit down and take a closer look at things. And by the way, when we say, “review your holdings,” we mean all of them. That includes any and all institutions you do business with! (Many investors sometimes forget where all their assets are kept and thus fail to review them. Or they review them separately and don’t ensure they work together.)

Review Your Exposure to Volatility

At the same time, it’s important to be sure that you are prepared to weather any market volatility that may happen in 2024. As you know, we’re in an election year. We’re also still contending with higher-than-normal inflation and much higher-than-normal interest rates. All these factors can contribute to increased turbulence in the markets. For that reason, we need to be sure you are not overexposed to certain sectors that may be particularly vulnerable to volatility this year. If you would like a second opinion on investments held in other places, we would be happy to provide one.

Determine Your Insurance Needs

In many parts of the country, the return of spring means the imminent return of storm season. It also means new opportunities for outdoor recreation. While it may be unlikely, that means an increased chance of both property damage and/or personal injury. While you don’t need to go out and start buying more insurance, this is the time when you should review where you are covered and where you are not. That way, you can determine if there are any critical gaps that are simply too risky to leave unfilled. For example, while most mortgage lenders require customers to have home insurance, few people have property insurance. For those with property in areas where major storms, wildfires, hurricanes, or tornados are common, that’s a type of gap that really should be filled.

Budget For Your Summer Vacation Plans

This one’s more fun. If you have plans for a big cross-country road trip, a long-awaited tour of Europe, or family fun in Disneyland, take time now to set a budget, purchase tickets, and make reservations. It can save you a lot of money if you do it early. Money you can use for further adventures in the future!

Decide What to Do with Your Tax Refund

If you’re getting a tax refund this year, think about how you want to use it. Approximately 1/3rd of Americans use their refund to pay off debts; others stick it in a savings account.1 One underrated and oft-underused option: Invest it instead. It can help you catch up on saving for retirement, pay for a loved one’s college expenses, or enable you to achieve one of your long-term goals even sooner.

Get Your Tax Planning Done Early

Finally, once your taxes are filed and the rush is behind you, consider pivoting from tax preparation to tax planning. While tax prep is the process of filing taxes you already owe, tax planning is the process of minimizing taxes you will owe in the future. By doing this early, you can potentially reap great rewards in the near future.

1 “Over a third of Americans plan to spend their tax refund right away, mostly to pay bills,” CNBC, www.cnbc.com/2022/04/02/mostamericans-plan-to-spend-tax-refund-on-essentials.html