Back to Basics #5: Planning for Health Care Expenses

We have been sharing a series of articles called “BACK TO BASICS.” In each article, we examine one of the basics of financial planning. Let’s look at:

Back to Basics #5:

Planning for Health Care Expenses

Take a moment to think about the future. What do you see yourself doing? Traveling the world? Starting a new business? Playing with grandkids? Taking up that hobby you’ve always dreamed of doing? Getting in shape? Improving your short game? Or maybe just relaxing and reading a book? Whatever it is that you see, the future probably looks pretty exciting!

Unfortunately, there’s something else the future holds that no one can avoid.

Maybe it won’t happen for a few more decades. Maybe it’s already happening. But at some point, in the future, your body will start to slow (and even break) down.

They say age is a state of mind, but it’s also a fact of life – and this fact means inevitable changes to both your health and your pocket book. Make no mistake, your medical expenses will go up as you get older. But many people fail to plan for these costs.

Those that do plan often underestimate exactly how much their medical expenses will cost. For example, a recent study by Fidelity Investments found that the average couple retiring at age 65 will need at least $280,000 to pay for their health-care costs in retirement.1 Another study done by the Employee Benefits Research Institute found that “a 65-year-old man and woman would need $127,000 and $143,000, respectively, if they want a 90% chance of covering all their health care costs…in retirement.”2

That’s a lot of money. There are just so many aspects to health care that you may need to pay for some day. There’s regular visits to your doctor, medicine, surgeries, hospital stays, long-term care, and more.

Hopefully this gives you a little glimpse of how important it is to plan for your health care expenses. But how do you pay for them?

The obvious answer is “work longer and retire later,” but let’s delve a little deeper. Here are a few things you can do:

1. Learn your various Medicare options.

If you are one of the lucky few who will have employer-provided health care coverage even after retirement, congratulations. But if not, start familiarizing yourself with the intricacies of Medicare now. The Federal government’s health insurance program for seniors is often referred to as a single plan, but , it’s many types of plans rolled into one. From the basic level of coverage (Part A) to “Medicare medical insurance” (Part B) which covers outpatient hospital care, physical therapy, and home health care, to the more elaborate “Medicare Advantage” plans, most retirees are confronted with too many options, some of which are more appropriate than others. Choosing the best type of coverage for you will be crucial when it comes to paying for your medical expenses.

2. Start saving and investing – now.

One of the smartest financial decisions you’ll ever make is to set up a rainy-day fund. This is where you regularly set aside a portion of your income for dealing with the unexpected. Whether that’s losing your job, dealing with a natural disaster – or yes, paying for unexpected medical expenses – a rainy day fund can make all the difference.

Similarly, if you invest wisely and consistently, you have the potential to grow your money for the future. That means you’ll have a better chance of being able to afford any health care costs that pop up in the future.

3. Consider long-term care insurance.

Important disclaimer: not everyone will need long-term care or assisted living in their lives. That said, many people do, and long-term care (LTC) insurance is one of the best ways to pay for it. It can be beneficial to purchase LTC insurance sooner rather than later, as premiums can get higher as you grow older. However, LTC is expensive in and of itself, so give the subject a lot of careful consideration before deciding.

4. Keep your body healthy.

We are financial advisors, not doctors or trainers, so we’re not in the business of providing tips on healthy living. But this tip is just common sense, and it’s amazing how often it gets overlooked. Keeping yourself healthy now can save you a lot of money in the future. By getting regular exercise, eating a healthy diet, sleeping enough, and quitting smoking (among other things) you can give yourself a better chance of avoiding future medical problems. Conditions like high blood pressure, diabetes, and cancer can extract a high toll on your finances as well as your health. Most people don’t realize this, but one of the best ways to ensure a financially secure future is to take care of your body in the present.

Over the last few months, we’ve tried to share a few basic tips on how to plan for and secure a bright financial future. They may seem overly simple, but they’re fundamental to your financial health. Remember:

“Winners don’t just learn the fundamentals, they master them. You have to monitor your fundamentals constantly, because the only thing that changes will be your attention to them.”

– Michael Jordan

By mastering the fundamentals of financial planning, you will get yourself much closer to achieving the future you’ve always dreamed of.

That’s it for our Back to Basics articles. We hope you’ve enjoyed reading them. Here’s to the future!

1 Elizabeth O’Brien, “Here’s How Much the Average Couple Will Spend on Health Care Costs in Retirement,” Time Magazine, April 19, 2018. http://time.com/money/5246882/heres-how-much-the-average-couple-will-spend-on-health-care-costs-in-retirement/

2 Sudipto Banerjee, “Cumulative Out-of-Pocket Health Care Expenses After the Age of 70,” Employee Benefits Research Institute, April 3, 2018. https://www.ebri.org/pdf/briefspdf/EBRI_IB_446.pdf

Back to Basics #4: Important Estate Planning Documents

A few months ago, we started a new series of articles called “BACK TO BASICS.” In each article, we examine one of the basics of financial planning and investing. This month, let’s look at:

Back to Basics #4:

Important Estate Planning Documents

Many people, young and old, don’t have a will, let alone a broader estate plan. Yet an estate plan is important, even for families who are not wealthy.

An estate plan serves four major purposes:

- It directs who will receive your property when you die.

- It minimizes probate costs and any estate taxes that might be owed on that property. It’s the estate tax that people tend to think about when they think of an estate plan, and because many people believe they don’t have an estate large enough to be taxed, they don’t bother drawing one up.

- It provides for care of minors (otherwise the state will become their guardian).

- It provides for your care if you are unable to provide for yourself. A proper plan ensures that you get to pick the caregivers, not the state. This is critical for young people, singles, and older persons.

You may be thinking, “I have a will so I’m all set.” While having a will is a very important part of your estate plan, it’s not the only part. A will doesn’t specify how you want to be treated should your health fail. It doesn’t dictate who will carry out your wishes or handle your financial affairs should you ever become incapacitated. It doesn’t help your heirs limit their tax burden.

In other words, it doesn’t cover all of the purposes of an estate plan as listed above.

To ensure that both you and your loved ones will be cared for, we’ve created a list of four key documents that should be in every estate plan:

Will

We mentioned that creating your will is an important aspect of estate planning, so let’s cover that first. A will states how you want your belongings divvied up amongst your loved ones after you pass away. Otherwise, the government will determine how to distribute your property, which may even end up belonging to the state if you don’t have an appropriate will stating otherwise.

Power of Attorney

Another crucial document is your power of attorney, which allows you to appoint someone to act on your behalf to make legal decisions about your property and finances. That person, usually referred to as an “agent”, could be a trusted friend, a family member, or an experienced, reputable professional.

Power of attorney is crucial should you ever become ill or disabled to the point where you can no longer make important decisions yourself. Keep in mind, however, that granting someone power of attorney is a huge decision in and of itself. Give careful thought before making your choice. Whomever you select should be trustworthy, reliable, and mature enough to handle the responsibility.

Advance Medical Directive

A third document is your Advance Medical Directive. This catch-all term refers to health care directives, living wills, health care (medical) powers of attorney, and other personalized directives. These documents allow you to legally express your preference for continued health care should you become terminally ill.

A word of advice. As you finalize your Advance Medical Directive, make sure you have completed your HIPPA Release Forms as well. By having this special form completed, you enable the individuals named in your Advanced Health Care Directive to have access to your healthcare information. This way, they can deal with insurance matters on your behalf at a time when you cannot.

Letter of Instructions

Last, but not least, is a Letter of Instructions. This is document gives your survivors information about important financial and personal matters to attend to after your passing. You don’t need an attorney to prepare it. Although it doesn’t carry the legal weight of a will, and is in no way a substitute, your Letter of Instructions will clarify any special requests you want carried out after death. It may include your funeral preferences, people to notify, account passwords, directions regarding certain possessions, or anything else you’d like your survivors to know.

The four documents listed above are all very important, and every adult should have them in their estate plan. Having each of these important documents prepared ahead of time can relieve your family of needless worry, speculation, and expense. Keep in mind, however, that while this letter is a good overview of some important estate planning documents, it certainly doesn’t cover everything. When it comes to planning for your financial future and those of your loved ones, remember that there are many factors to consider. If you haven’t yet completed the documents described above, or if your circumstances have changed and you haven’t updated your estate plan accordingly, it’s high time to do so. Because when it comes to planning, there’s no such thing as starting too early.

But there is such a thing as too late.

Your overall financial plan isn’t just about investments and money. As financial advisors we take a wholistic approach and know that a plan is only as strong as its weakest link. While we aren’t attorneys who can create these documents, we do want to make sure our clients have taken care of this very important part of the overall planning process.

If you don’t have an attorney and would like an introduction, please let us know. The coordination of all advisors is very important.

| Check out other articles | |

| Back to basics 3 investment funds | |

| Back to basics 5 planning for health care expenses | |

| Bonds in a rising interest environment | |

| Business owner 401k checkup | |

Back to Basics #3: Investment Funds

A few months ago, we started a new series of articles called “BACK TO BASICS.” In each article, we examine one of the basics of financial planning and investing. In this article, we’ll look at:

Back to Basics #3:

Investment Funds

While it’s possible to invest in individual stocks, bonds, and other securities, many investors prefer to use investment funds.

An investment fund is when a group of investors pool their money together to collectively invest in a certain way. This makes it simple and easy for individuals to invest in a wide range of securities at the same time. There are several types of investment funds, and as you can imagine, each comes with different pros and cons.

Funds are very popular, but in our experience, most people don’t know how they work or which type is right for them. We can’t answer that second question here, of course, but we can at least give you a breakdown on how some of the main types work.

Quick disclaimer before we go any further: Every type of investment comes with risk. And nothing you’re about to read should be taken as an endorsement or a recommendation. We don’t do that sort of thing in an article.

Okay, ready? Let’s start with:

Mutual Funds

Here’s how the Securities and Exchange Commission (SEC) defines mutual funds:

A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. The combined holdings of the mutual fund are known as its portfolio. Investors buy shares in mutual funds. Each share represents an investor’s part ownership in the fund and the income it generates.1

There are two main types of mutual funds: actively-managed, and passively-managed. More on the latter in a moment. An actively-managed mutual fund means the fund employs one or more managers to perform investment research, select the individual investments in the fund, and monitor performance.

Many investors flock to mutual funds because they offer several potential benefits:

- The possibility of “outperforming” the market. If a manager picks the right investments at the right time, it’s possible the fund could bring a higher return than the overall market.

- Diversification. Mutual funds often invest in a wide range of companies and industries in order to lower your overall risk. This means that if one company or industry does poorly, you may not experience the same kind of loss that you would if all your money was invested in that company or industry.

There are potential issues with mutual funds, though. Statistically, most funds do not outperform the market – or at least not for very long. Mutual funds often come with more expenses than other funds, too, including management fees. These expenses can eat into your returns, thereby lowering your overall profit. For this reason, some people prefer to invest in:

Index Funds

Remember how we said there were two types of mutual funds, active and passive? Passive means the fund does not have a manager actively choosing investments. Instead, the fund tracks a specific index, like the S&P 500.

Understand, it’s not possible to invest in an actual index. What an index fund does is invest in the same companies that make up a particular index. Some funds will invest in all the companies in an index, while others will rely on a “representative sample.”

With an index fund, you’re essentially tying your fortunes to what the target index does. If the index goes up, so does the fund – and vice versa. The downside is that this makes investors particularly vulnerable to overall market volatility. During a bear market, for example, an index fund could suffer heavily. The upside is that the markets generally go up over the long-term. Another benefit? Index funds often have far lower expenses than mutual funds and “more favorable income tax consequences.”2

Exchange-Traded Funds

ETFs, as they are often called, can be similar to either mutual funds or index funds. Some ETFs are actively managed; most, however, track the companies in a specific index.

But ETFs differ from other types of funds in a few key ways. For one thing, the shares each investor has in an ETF can be traded on the open market. That means you can buy or sell your shares in an ETF just like you would an individual stock. You can’t do that with regular mutual- or index funds. That’s a big advantage for investors who value flexibility and liquidity.

Most ETFs also come with lower expenses than mutual funds.

But of course, nothing’s perfect. While ETFs can be traded like common stock, if you trade too often, you may find yourself paying more than you anticipated in trading fees. Then, too, some ETFs are thinly traded, meaning there’s just not a lot of activity between buyers and sellers. This can make it difficult to sell your shares.

Conclusion

There is a lot more information we could share on each of these types of funds that we just don’t have room for in a letter. Keep in mind, too, that there are many ways to invest. Each comes with its own advantages and disadvantages. Different professionals may say that one is better than the other, but what’s important is choosing what’s right for you. That’s why it pays to take a little time to educate yourself on how they work and what they’re for.

That’s why we’re going Back to Basics.

In our next article, we’ll pivot away from investing to something a little more personal.

1 “What are Mutual Funds?” Securities and Exchange Commission, https://www.investor.gov/investing-basics/investment-products/mutual-funds

2 “Index Funds,” Securities and Exchange Commission, https://www.sec.gov/fast-answers/answersindexfhtm.html

| Check out other articles | |

| Back to basics 4 8important estate planning documents | |

| Back to basics 5 planning for health care expenses | |

| Bonds in a rising interest environment | |

| Business owner 401k checkup | |

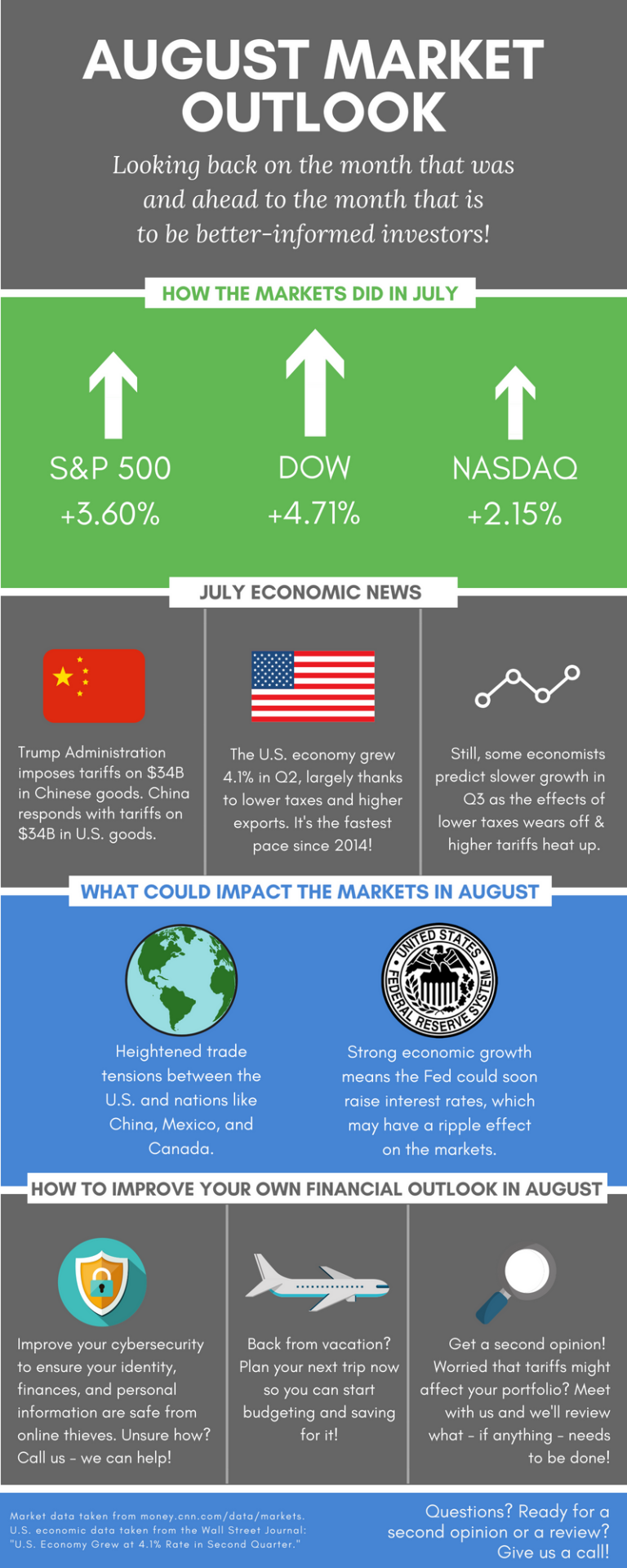

Summer Trade War

“Printing ink, not black, solid.”

“Yarn (not sewing thread) of synthetic staple fibers, mixed mainly with artificial staple fibers.”

“Meat of swine other than hams, shoulders, bellies and cuts thereof, salted, brined, or smoked.”

“Organic surface-active products and preparations for washing the skin, in liquid or cream.”

You’re probably wondering what in the world we’re talking about.

The items above are just four of the five thousand products potentially affected by the trade war between the U.S. and China.1 Meat, vegetables, auto parts, construction materials, chemicals – it’s all part of more than $200 billion in tariffs proposed by President Trump’s administration.2 China, in turn, has imposed tariffs on over five hundred American products worth approximately $34 billion.3

And that’s not getting into all the trade-related skirmishes between the U.S. and Canada. Or the U.S. and Mexico. Or the U.S. and the European Union.

We’re sure you’ve heard at least something about these tariffs in the news. But unless you do it for a living, trying to keep track of every development or possible outcome is dizzying, to say the least. In fact, many of our clients have reached out to ask the following questions:

“What’s going on, and why?

“Why does it matter?”

“What’s going to happen?”

As your financial advisors, it’s our job to answer your questions! So, let’s cover each of these in this letter. We’ll start with:

What is a trade war, and why is there one in the first place?

A trade war, in case you’re not familiar with the term, is an economic conflict in which countries impose import restrictions on each other to harm each other’s trade.

Why is the U.S. in a trade war with China?

The issue, at least from the U.S. administration’s standpoint, is a $375 billion trade deficit4 with China, which many see as being due to unfair or even illegal trade practices. China, on the other hand, contends the deficit has more to do with American fiscal policy, and the fact that the U.S. exports services more than goods.

A trade deficit is the difference between how much a nation imports from another country compared to how much it exports. One of President Trump’s earliest campaign promises was that he would decrease the trade deficit. His tool of choice?

Tariffs.

Put simply, a tariff is a tax on goods produced in another country. Tariffs make foreign goods more expensive, so, in theory, people will become more likely to buy local products instead. For example, a tariff on foreign steel would prompt consumers to buy more steel from American companies. That would be an enormous boost for the American steel industry.

Tariffs can also be used as a negotiating tactic of sorts. If Americans buy fewer Chinese products, that could lead to economic pain for many Chinese companies. This, President Trump believes, will drive China to the negotiating table. Then, he can broker a new trade agreement that will be more favorable to the United States.

Historians and economists are divided on whether tariffs are a good idea. That’s because tariffs can come with negative side effects. For one thing, higher prices can make life difficult for consumers, whether they be individuals, families, or businesses. To return to our steel example, if a company must pay more for the steel it needs, that could significantly eat into its own profits.

And of course, tariffs can lead to trade wars. In this case, American industries that produce goods China has slapped tariffs on could experience a massive drop in revenue.

Timeline of the trade war so far

| Date | Event5 |

| March 1 | President Trump announces 25% tariff on imported steel and 10% on aluminum |

| April 2 | China issues tariffs on $2.4 billion U.S. exports |

| April 3 | President Trump announces new list of tariffs on $50 billion worth of Chinese goods |

| April 4 | China responds by issuing tariffs on roughly $50 billion in U.S. goods |

| April 5 | President Trump proposes tariffs on another $100 billion in Chinese goods, but does not yet impose them. |

| June 15 | President Trump releases an updated list of tariffs worth $50 billion, to go into effect on July 6. China responds with a revised list of $50 billion in U.S. products, to start on the same date. |

| July 6 | Tariffs on $34 billion in Chinese goods go into effect, as do Chinese tariffs on the same amount of U.S. goods. |

| July 10 | President Trump proposes a 10% tariff on another $200 billion in Chinese imports. |

As you can see, the numbers are so large, and seem to change so often, that it’s not exactly easy to keep track. But for now, tariffs on $34 billion in goods have been implemented by both the U.S. and China, with many more proposed.

Why does this matter?

A bit of news that broke on Tuesday, July 24, serves as a good illustration. The Trump Administration announced its plan to provide $12 billion in aid to farmers and ranchers who may be hurt by Chinese tariffs.6 While China has proposed fewer tariffs than the United States, they have chosen their targets with care. Specifically, they have targeted industries largely located in states that voted for President Trump in the 2016 election. Think soybean farmers, automotive dealers, manufacturers, etc. It’s still early, but if history is any judge, these industries could soon feel the pain of lost revenue, wage cuts, and even job losses.

If the Trump Administration is right and tariffs lead to more favorable trade deals, that could be a major benefit in the long run. But in the short term, well… there’s a reason that economists call it a war. There may be no bloodshed, but that doesn’t mean there’s no pain.

From an investor’s perspective, this all matters because prolonged economic pain can lead to prolonged market volatility.

So how are the markets taking all this?

The quick answer: In stride.

If you follow the markets closely, you’ll notice a pattern: Whenever a new salvo of tariffs is launched, by the United States, China, or whoever, the markets tend to dip. In fact, 100-point falls are not at all uncommon in the Dow. But then a funny thing happens: The markets recover a day or two later. Why is this? Supply, Demand, Earnings, Inflation, Deflation, Interest Rates, Corporate news, etc. etc. The point is, market performance is based on so many factors. Even something as important as international trade is just one ingredient in the cake.

That’s why trying to predict what the markets will do is a fool’s errand.

Right now, the markets are still being powered by a strong economy and lower taxes among other things. As we mentioned before, the trade war is still in its infancy, so its effect on the markets has been muted compared to what some analysts might have expected.

But trying to predict where the markets will go next is harder than trying to predict the weather. Meteorologists rely on a huge array of computers, algorithms, satellites, and techniques to give people a reasonable expectation of what the weather will be tomorrow – and they’re still often wrong! That’s because the weather is a vast, complex system. There are so many factors, so many variables, each affecting the other. The markets are much the same.

We could certainly try to guess how the next round of tariffs will impact the markets. But then we’d be ignoring all the other variables mentioned earlier. We’ve said it time and time again: No one has a crystal ball. And a crystal ball is exactly what you’d need to know where something as vast and complex as the stock market will go.

Which is why our investment strategy is based on principles, not predictions.

What are those principles? For starters, we invest for the long-term. We avoid making emotional decisions. We don’t overreact to the day-to-day swings of the market. We choose investments based on you: your goals, your comfort-level with risk, your time frame.

The current trade war, especially between the U.S. and China, is an important story, and one we’ll keep monitoring. But from an investing standpoint, right now it’s just a story. And we don’t allow stories to affect our strategy. Of course, if at any point we feel the trade situation could harm our clients’ portfolios or impede their progress towards their goals, we’ll let them know immediately.

In the meantime, remember: Our team loves hearing from you! Please let us know if you have any questions or concerns. Our door is always open.

1 “What’s at stake in US-China trade war,” The Financial Times, July 19, 2018. https://ig.ft.com/us-china-tariffs/

2 “Trump Administration Prepares $200 Billion In Additional Tariffs on Chinese Imports,” Time, July 10, 2018. http://time.com/5335200/trump-200-billion-additional-tariffs-chinese-imports/

3 “China hits back after US imposes tariffs worth $34bn,” BBC News, July 6, 2018. https://www.bbc.com/news/business-44707253

4 “U.S. Announces Tariffs on $50 Billion of China Imports,” The Wall Street Journal, April 3, 2018. https://www.wsj.com/articles/u-s-announces-tariffs-on-50-billion-of-china-imports-1522792030

5 “The U.S.-China trade war has begun. Here’s how things got to this point.” The Washington Post, July 6, 2018. https://www.washingtonpost.com/news/worldviews/wp/2018/07/05/a-timeline-of-how-the-u-s-china-trade-war-led-us-to-this-code-red-situation/

6 “Trump to offer farmers $12B in trade aid,” Politico, July 24, 2018. https://www.politico.com/story/2018/07/24/trump-trade-aid-for-farmers-737108

Back to Basics #2 – Asset Allocation

In April, we started a series of articles called “Back to Basics” where we look at the basics of financial planning and investing.

We shared this article in our most recent newsletter. We wanted to share it again via email as a pimer for next week’s Back to Basics #3 Investment Funds.

Back to Basics #2:

Asset Allocation

When it comes to investing, there’s a lot of terminology and jargon you might see bandied about by financial professionals or the media. Most of these terms are not hard to understand – but they may seem baffling at first glance.

Understanding some basic investing terms is helpful, because it can help transform investing from some arcane art into a simple process. And the more you see investing as a process based on rules and logic, rather than something based on emotions, the more likely you will find success.

One important term every investor shoulder understand is asset allocation.

Improper asset allocation is one of the most common mistakes an investor can make. Why is asset allocation so important? Look at it this way: If you were to eat only one food every day for your entire life, your body would be very unhealthy. If you were to exercise only one group of muscles for your entire life, your body would be very weak. And when you invest all your money in the same way, the same could be true of your finances.

Asset allocation is basically a strategy that spreads your investments across different “asset classes.” The three main classes are equities (stocks), fixed income (bonds), and cash. There are other classes, of course, like commodities and real estate. And there are sub-classes as well. For example, “stocks” can be divided up into many different classes, like international stocks, small, mid, and large-cap stocks, etc.

The thinking behind asset allocation is that by mixing your investments within these different classes, you take on less risk. That’s because if one class goes down in value, the other classes you’ve invested in can compensate.

Here’s an example of why asset allocation is so important. Let’s say that in Year 1, the stock market goes through the roof. So, you put all your money into stocks. But in Year 2, the stock market performs poorly. It’s possible you could end up losing a lot of money.

Now let’s say that instead of putting all your money into stocks, you put 50% into the bond market. When the stock market went down, investors started pouring their money into bonds, causing bond prices to go up. That means that even though your stock holdings decreased in value, your bond holdings increased, meaning you could still break even or possibly come out ahead.

Of course, this is a very general, very simplified example. We’re certainly not recommending you do anything like that. (We would never recommend any particular investment or strategy to anyone without first sitting down and learning more about their goals, needs, challenges, and fears.) But hopefully it illustrates the point: Putting all your eggs in one basket is rarely a good idea.

Back to Basics #1: The Seven Most Important Retirement Dates

Michael Jordan, perhaps the greatest basketball player who ever lived, once said:

“Winners don’t just learn the fundamentals, they master them. You have to monitor your fundamentals constantly, because the only thing that changes will be your attention to them.”

But fundamentals aren’t just about succeeding on the court. They’re crucial to your financial success, too. Understanding the basics of financial planning can be the difference between achieving all your goals, or none of them.

For that reason, we have started a new series of emails called “BACK TO BASICS.” In each email, we will examine one of the basics of financial planning. To start, let’s look at:

Back to Basics #1:

The Seven Most Important Retirement Dates

- Age 55. When you turn 55, you can start making penalty-free withdrawals from your 401(k). Withdrawing money before this is possible, but it usually results in some pretty stiff fines. That said, making withdrawals at age 55 is usually not recommended. It’s better to keep your money where it is or roll it over to an IRA. Unless you are retiring at a very young age, chances are you will have far greater need for that money later in life.

- Age 59½. This is when you can make penalty-free withdrawals from both your 401(k) and your IRA accounts. Again, I recommend holding off unless you plan on retiring right away.

- Age 62. This is the earliest you can receive Social Security benefits. That said, your benefits will decrease if you receive them early. Are you noticing a pattern here?

- Age 65. Age 65 is when you can sign up for Medicare. Tip: Applying three months before you turn 65 may help you save money on certain costs, like prescription drug coverage. This is also when people born before 1943 reach their full retirement age, or FRA. More on this a moment.

- Age 66-67. Those born between 1943 and 1959 reach their FRA at 66. For those born in 1960 or later, the age is 67.

What is your “Full Retirement Age”?

The Social Security Administration defines your full retirement age as “the age at which a person may first become entitled to full or unreduced retirement benefits.”1 As mentioned, you can start receiving benefits at age 62, but the amount will be reduced. On the other hand, if you wait until your full retirement age, you will receive the full amount of benefits to which you’re entitled.

Assuming your FRA is 67, here’s how it works1:

|

If you take benefits at age… |

Your benefits will be reduced by around… |

|

62 |

30% |

|

63 |

25% |

|

64 |

20% |

|

65 |

13.3% |

|

66 |

6.7% |

|

67 |

No reduction |

- Age 70. While waiting until your full retirement age ensures unreduced benefits, waiting even longer can help maximize them. As the Social Security Administration puts it, “Retirement benefits are increased by a certain percentage (depending on date of birth) if you delay your retirement beyond full retirement age.”2 However, this only lasts until your 70th birthday. One you hit the big 7-0, there’s no point in waiting any longer, because your benefits won’t go up.

- Age 70½. This is the age at which you must take required minimum distributions, or RMDs, from any pretax retirement accounts like your 401(k) or IRA. This means you must start withdrawing money from these accounts to help pay for retirement. If you fail to withdraw at least the minimum amount, you will be required to pay a penalty.

It’s important to remember dates because they can help you avoid penalties and maximize your savings.

We’ll continue this series by going over some important financial terms everyone should know.

1 “Full Retirement Age,” Social Security Administration, https://www.ssa.gov/planners/retire/retirechart.html

2 “Delayed Retirement Credits,” Social Security Administration, https://www.ssa.gov/planners/retire/delayret.html