Diversification: Cure or Curse

Investment terms and investment language have a tendency to be confusing and frustrating. However one term that seems to reach immediate common understanding is diversification. It’s so universal that most times there is no need for explanation. That’s the good news. The bad news is that “diversification” is used so liberally, that it is not how the word is defined that is critical, it’s how the word is used.

Investment terms and investment language have a tendency to be confusing and frustrating. However one term that seems to reach immediate common understanding is diversification. It’s so universal that most times there is no need for explanation. That’s the good news. The bad news is that “diversification” is used so liberally, that it is not how the word is defined that is critical, it’s how the word is used.

Diversification as a broad concept is simply the law of large numbers. As an investor, the greater the number of different investments that you hold, the more protected you are against absolute loss. “Don’t put all your eggs in one basket.” A good example of this involves the now defunct corporation Enron. If you owned 100 different stocks, one of which was Enron and you watched Enron go bankrupt, you could say to yourself, “thank goodness I was diversified, I still have 99 stocks.” You were, in fact, protected from absolute loss by having a diversified portfolio.

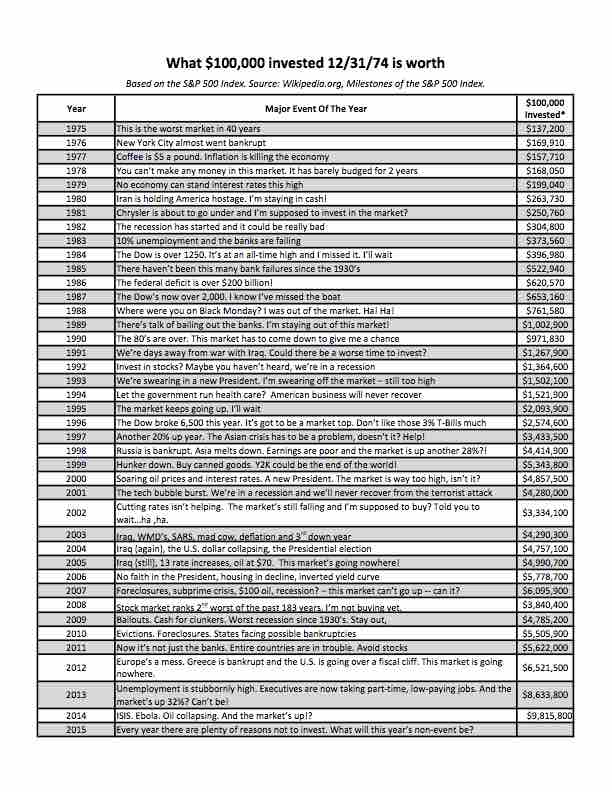

When the term is used in connection with managing market volatility, things get a bit more complicated. Simply owning hundreds of large US stocks when the US stock market is in decline, won’t do much to protect the investor from market volatility risk. If you owned an S&P 500 index fund in 2008 and simply rode out the year, you were by definition diversified; however, your portfolio experienced the same volatility as the market.

Being able to manage market volatility is about enjoying the ride, and surviving catastrophes. The term asset allocation and diversification often get incorrectly used synonymously, though they are related in terms of managing market volatility. The term asset allocation is simply diversification of capital across the broad asset classes. So for example, the six broad asset classes are: US equity, international equity, commodities, fixed income, currency, and cash. Over the last 40 years, the investment community has focused on the decision on how much to allocate to the six asset classes.

There are three benefits to that decision:

- Reducing volatility (the month-to-month change in portfolio value)

- Improving portfolio response to financial catastrophes

- Improving performance using the right combination of investments.

In general, diversifying a portfolio across the broad asset classes changes the inherent risk of market volatility. Simply stated: the more money that you have in stocks, the greater the risk and the more money that you have in bonds and cash, the lower the risk.

Okay this is where it gets really complicated. Asset allocation can be applied passively or actively. Passive allocation, often called “buy and hold” means that you are able to determine, as a rational human being, what the best combination of asset classes for you is and you hold that through the ups and downs in the market. This is the current “cure-all” that is often offered to private investors.

There are a few problems with this cure-all though. First, it’s very difficult for us all to be rational and unemotional about money. After all, the loss of money means reducing our personal options in life, which is no fun for anyone. In addition, once you admit to the desire to change the allocation to your investments in any of the broad asset classes, you open the door to the curse of when and how do you do it. (You shift from a passive approach to an active or tactical approach) Tactically allocating or diversifying among the broad asset classes allows investors to take a more proactive approach to managing market volatility risk. However, the “tactics” that you might use to make the decision of redeployment of capital open the door to the same problem that you had before you started the process, which is how do I best allocate and diversify my portfolio?

Instead of falling through the trap door of diversification, we believe instead, the following: diversification using the law of large numbers is a good thing to protect against absolute loss. A good example is the use of index funds covering either broad market indexes such as the S&P 500 or the Dow Jones industrial average, or sectors like financial services or healthcare. Additionally, decisions on making tactical changes to your asset allocation need to be handled on an ongoing basis, and this diversification among the broad asset classes, when done properly, can help protect against short-term volatility and long-term catastrophe.