Have you ever noticed how so many idioms refer to the duality of life? Consider: There are two sides to every coin. Life is a double-edged sword. You can see the glass as half-full or as half-empty. Every cloud has a silver lining.

Each of these sayings refers to the fact that almost everything in life can be seen as either good or bad; it’s all based on what we focus on. Sometimes, it can even depend on which “side” we see, hear, or learn about first. Even science has found this to be true. For example, in 2014, two psychologists named Angela Legg and Kate Sweeny ran an interesting study. Two groups of people filled out a personality inventory. The first group was told they would get feedback, some positive, some negative. The second group learned that they would be the ones to give it.

The study found that 78% of the people in the first group wanted to hear the negative stuff first.1 That’s because they believed that if they got the bad news out of the way, they could end on a good note, and their day wouldn’t be ruined.

The second group – the ones giving the feedback – were divided. Roughly half focused on what they thought the recipient would want to hear and decided to give the bad news first. The other half focused on their own feelings and decided to give the good news first, because they felt it would be easier to start off with something positive. Either way, just about everyone in the study was preoccupied with the order in which to face both sides of the situation. It didn’t matter if both the good and bad were roughly equal. What mattered was mindset.

We were thinking about this recently while pondering our next market message. The very message, in fact, that you are reading now. You see, there is a real duality to the markets at the moment. Storylines pulling the markets down, storylines pushing them back up. But which to focus on? Which to start with?

Given what we learned from that study we mentioned, we think we’ll start with the “bad” news before sharing the “good.” Then, we’ll explain why, when you think about it, it really doesn’t matter.

Interest Rates and Bank Failures

Perhaps the biggest drag on the stock markets – not just now but over the last year – has been the steady rise of interest rates. The most recent hike came on May 3rd, bringing rates to a 16-year high of 5.25%.2 Essentially, the Fed has spent the last year trying to combat inflation by cooling down the economy. When rates are low, consumers and businesses are incentivized to borrow and spend. But when rates are high, it’s meant to reward saving overspending. If people spend less and demand for goods and services goes down, companies have little choice but to lower prices if they’re to attract new business.

Unfortunately, these rate hikes are very much a – wait for it – double-edged sword. Because while they do serve as a deterrent against inflation, they can depress economic activity to the point of a recession. This fear of a recession, accompanied by lower earnings from many companies as a result of higher interest rates, has triggered some of the volatility we’ve seen in recent months.

But rising interest rates have done something else, too: Threaten the solvency of America’s banks.

On March 10, federal regulators seized Silicon Valley Bank, the sixteenth largest in the country. Two days later, New York’s Signature Bank collapsed. And on May 1st, First Republic Bank in San Francisco was seized, too, with most of its assets promptly sold to JPMorgan Chase. Given how suddenly – and consecutively – these regional banks fell, many investors have been gripped by fear of contagion spreading across the entire banking industry.

While none of these situations were exactly the same, all three banks had certain things in common. For one, all made long-term investment bets that turned out to be far too risky. In the case of Signature Bank, this was in cryptocurrency, the value of which has plummeted in recent months. In the case of Silicon Valley and First Republic, it was placing far too much money in U.S. Treasury bonds. When interest rates began rising, the value of these bonds fell. Suddenly, these banks held most of their money – their depositors’ money – in assets that no one wanted. Furthermore, all these banks had an unusually high number of uninsured deposits. As a result, customers began withdrawing their money in droves. No bank can survive without deposits, forcing the government to step in and take over before everyone lost everything.

Now, three banks – out of the thousands that exist in the U.S. – may not sound like much. But since this started, investors have been combing the industry with a magnifying glass, trying to find which other firms might have hidden weaknesses. This has caused many banks’ stock prices to fluctuate wildly in recent weeks, acting as a further drag on the markets as a whole. It’s also added to recession fears. That’s because regional banks like these play a vital role in helping families, local businesses, and startups participate in the broader economy.

In each of these cases, the government has acted quickly in order to prevent any contagion from spreading. So, if all this banking turbulence stops with First Republic, well and good. But if other regional banks experience more credit shocks or a fire sale on their stock prices, this may well be a case of getting out of the frying pan only to fall into the fire. Stay tuned.

So, that’s the “bad news”. Now, let’s turn to a new subject that could be seen as either good or bad, depending on how you look at it.

Inflation

Since 2021, inflation has been the root cause of almost every bit of economic uncertainty. But the role inflation plays has changed over time.

The current spike in inflation started due to an explosion of economic activity after the COVID-19 lockdowns. Buoyed by historically low interest rates, Americans were shopping again, and not just for distractions to keep them busy while they were stuck at home. But this pent-up demand far exceeded supply, causing prices to skyrocket. Later, inflation became more driven by snarls in global supply chains. Then, it became exacerbated by the war in Ukraine. All these factors simply made it very difficult – and expensive – to get goods where they needed to be.

Lately, though, inflation has changed again. Now, the single biggest factor is not the price of goods, but of services. People aren’t just buying things again; they’re doing things again. Eating out at restaurants, going to sporting events, putting their children in daycare, and traveling. Meanwhile, a strong labor market has led to extremely low unemployment and rising wages. This has caused businesses to raise prices to compensate.

For these reasons, inflation remains stubbornly high, even after a year of rising interest rates. But here is where you can see the glass as either half full or half empty. The half-empty view would be that inflation remains high, meaning the Fed could keep raising rates. But the half-full view is that these same factors keeping inflation high are also keeping us out of a recession. (More on this in a moment.) Then, too, prices are coming down…just very, very slowly. (Back in March, prices were up 5% compared to the same time last year; that’s down from the 6% mark we saw in February.3)

Finally, let’s get to the “good” news…unless, of course, you’re the Federal Reserve, proving that even good news can be a double-sided coin.

Jobs

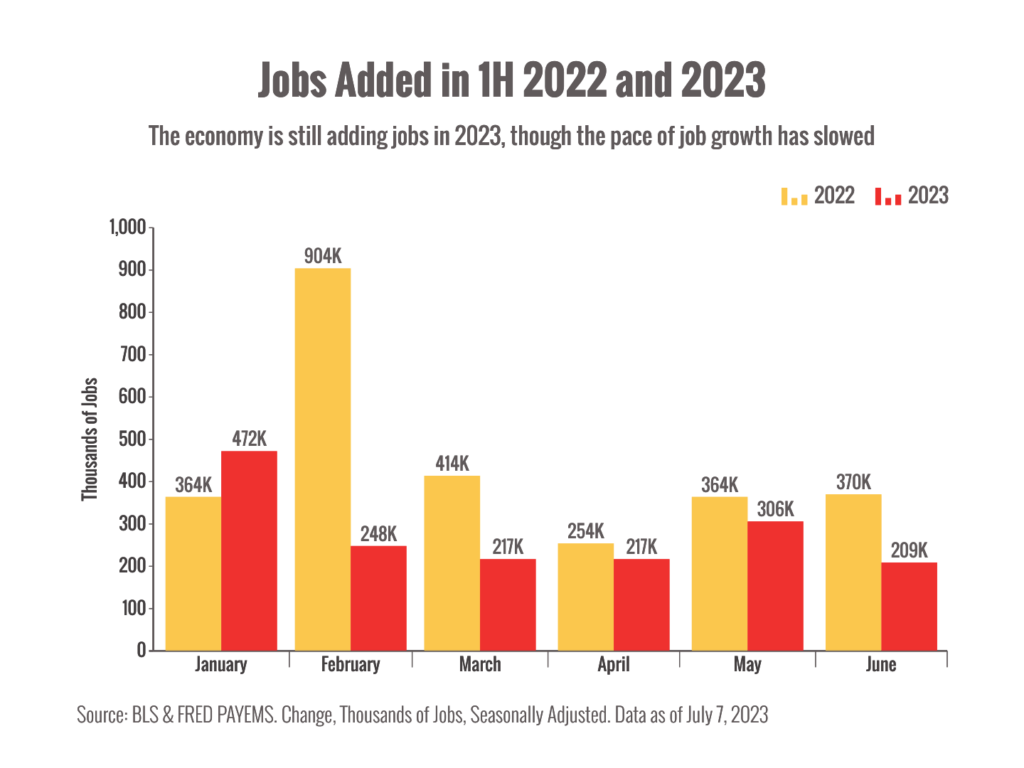

For months, analysts have predicted the labor market would slow down. Because of higher interest rates, companies would stop hiring, or even lay off workers. To be frank, this is what the Federal Reserve wants – at least to a degree. Because it’s this sort of economic cooldown that will tamp down prices. But it’s also been a main source of recession-based fears. When unemployment starts rising, a recession is often not far behind.

To date, however, it hasn’t happened. In April alone, the economy added 253,000 jobs. That’s far more than what most economists predicted. In fact, it’s brought the unemployment rate even lower, to 3.4%. That matches a 53-year low!4

This is terrific news. The more jobs there are, the more spending there is. The more spending there is, the more the economy will grow…or at least, not contract to the point of a recession. But unbelievable as it may seem, there is a counterargument. These job numbers may prompt the Fed to keep raising rates if they believe the economy can handle it…thereby injecting more uncertainty into the stock market and bringing us closer to a recession. Only time will tell which way investors decide to spin it.

The Takeaway

So, what are you thinking right now? Are you feeling positive or negative about the markets? On the one hand, we devoted more words to the “bad” news. On the other, we finished with a (mostly) positive note, with lower inflation and higher employment.

To be honest, however you react to all this says more about you – and more about how we wrote this message – than about the markets themselves. And that is exactly the point.

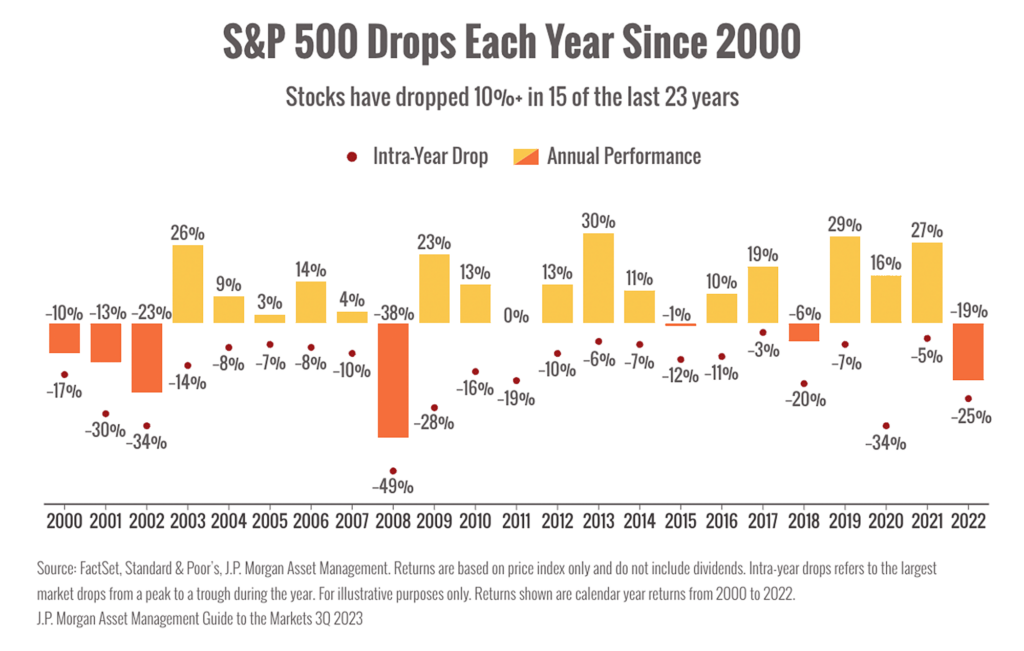

Positive and negative. Good news and bad. Yin and yang. Jekyll and Hyde. Dark side and light side. Half-full and half-empty. The fact is, there are two sides to almost every storyline impacting the markets right now. And most investors are picking and choosing what they react to, and how they react, based on which side of that duality they fall on. They choose one side of the coin, one edge of the sword. They turn investing into one big psychology experiment.

But we’re not most investors.

Moving forward, we need to accept that there are forces pushing the markets up and forces pulling the markets down. We can’t control which of those forces wins. Nor can we predict, day to day, which force will prove stronger. This is precisely why we have chosen a long-term strategy for investing. We don’t have to decide whether the glass is half-full or half-empty. We don’t have to stress over whether we hear the good news or the bad news first. We acknowledge both as important…but neither as everything. We don’t have to worry about guessing right because we never guess. Instead of guessing, we take a measured approach of analyzing the data, identify the areas of strength and weakness and make portfolio changes as necessary. As always, our team will keep watching all these storylines closely. In the meantime, our advice is to not stress about whether tomorrow’s news will be good or bad. We are always here to help you hope for the one and plan for the other…while remembering the words of one of our favorite idioms: Slow and steady wins the race.

1 “Why Hearing Good News or Bad News First Really Matters,” PsychologyToday, June 3, 2014. https://www.psychologytoday.com/us/blog/ulterior-motives/201406/why-hearing-good-news-or-bad-news-first-really-matters

2 “Fed increases rates a quarter point,” CNBC, May 4, 2023.

https://www.cnbc.com/2023/05/03/fed-rate-decision-may-2023-.html

3 “Inflation Cools Notably, but It’s a Long Road Back to Normal,” The NY Times, April 12, 2023. https://www.nytimes.com/2023/04/12/business/inflation-fed-rates.html

4 “US labor market heats back up, adding 253,000 jobs in April,” CNN Business, May 5, 2023. https://www.cnn.com/2023/05/05/business/april-jobs-report-final/index.html