Whipsawed and Loving It… The importance of a sell discipline for retirement investments

The importance of a sell discipline for retirement investment…

Whipsawed and Loving It

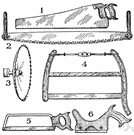

I went to the online dictionary Investopedia to look up the definition for “Whipsaw” and this is the definition: A condition where a security’s price heads in one direction, but then is followed quickly by a movement in the opposite direction. The origin of the term is derived from the push and pull action used by lumberjacks to cut wood with a type of saw with the same name. Look at the picture to the right, saw #2 is the best picture of a saw that can actual deliver a whip. Visualize 2 people holding the

saw, one on one handle, and one on the other handle. The benefit of using this saw is that one person at a time pulls on the saw and then lets their arms go slack so that the other person can pull the saw back. This increases the speed to cut a log and reduces the effort since 2 people do the sawing. In the investment world, whipsawed has come to mean typically that you sell a security as the price declines and then in a relatively short time the price reverses its negative path and goes back up above the price that you sold it at. Naturally if that happens, you feel like you have sold at the wrong time and now are reluctant to buy back the security at a higher price than you sold it at.

Risk management is defined as adopting a sell side discipline that protects your money as the market goes down. Sell discipline means that you have created a predetermined exit point that you execute absolutely as the market goes down. The exit point can be based a variety of measurements. We use relative strength as the measure. So for example if bonds exceed on a relative strength basis the relative strength of stocks it would meet one of exit points that we use on some of the portfolio models. Predetermined exit point means a percentage reduction in equity holding and a percentage increase in the bond holdings. Increasing bond holdings, most of the time, means decreasing risk in the portfolio. (Naturally depends on what type of bonds and the interest rate environment.) All of the above is good news if the overall stock market is going down. The bad news is that periodically you get “whipsawed”. Meaning your exit point was met and you take the predetermined action that I just mentioned. And then the market goes back up. Your thought could be, “I sold too soon.” Or your thought could be, “Wow, the sell discipline really works…THINK WHAT WOULD HAVE HAPPENED IF THE MARKET CONTINUED TO GO DOWN!”

The importance of sell side discipline, meaning the commitment to take action without hesitation, can save valuable portfolio dollars in a negative market. Now, what is the antidote for the negative side of “whipsawing”? The answer is you wait until your predetermined buy point and take action absolutely. Does this mean you could wind up increasing the portfolio’s percentage in stocks at higher price? Yes! Establishing sell points and buy points must be done with some margin between the points so that the buys and sells do not happen quickly and repeatedly. My experience has been that many people exit the market during negative trends but fail to get back in the market when the trend is reversed. Discipline, Discipline, Discipline! It is the price to be paid for “sleep through the night” money management comfort.